Today’s Market Trend

by Dr. Nancy Yamaguchi

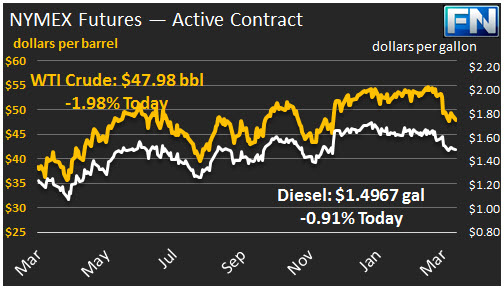

WTI crude prices have retreated below $48.00/b this morning. WTI opened at $48.70/b today, a small drop of $0.09 below Friday’s opening price. Current prices are $47.98/b, a significant drop of $0.80 below Friday’s close.

Diesel opened at $1.5117/gallon in today’s session. This was an increase of 0.71 cents from yesterday’s opening price. Current prices are $1.4967/gallon, a drop of 1.18 cents from Friday’s close.

Gasoline opened at $1.598/gallon today, an increase of 0.61 cents from Friday’s opening. Prices are $1.5851/gallon currently, a drop of 1.38 cents from Friday’s close.

Prices rallied early on Friday, but they stagnated toward the end of the day. Baker Hughes released it rig count data, showing a significant increase of 21 active rigs, 19 of which were horizontal rigs. The EIA reported that U.S. crude production rose by 21 kbpd for the week ended March 10th, bringing total U.S. output to 9109 kbpd. WTI crude prices still managed to end the week in the back, with Friday’s closing price at $48.78, $0.33 above Monday’s opening price. But early trading during the current trading session has seen prices waning.

On Friday, the Federal Reserve Bank of Atlanta published data from The Inflation Project. According to the Bank, firms have increased their business inflation expectations to 2.1% over the next twelve months. The Fed’s overall goal for inflation is 2.0%, and its latest forecast anticipates an average of 1.9% Core PCE inflation in 2017. Last week, Fed Chair Janet Yellen announced the FOMC’s decision to raise rates by 0.25%. The U.S. Dollar Index fell on Thursday and Friday, helping support oil prices.

The G-20 meeting in Baden-Baden, Germany, this weekend is being interpreted as a “win” by the U.S. The G-20 meeting communique omitted warnings about protectionism. The new U.S. position of “America First” appeared to make impossible any consensus on free trade, and the G-20 participants avoided making any strong statements on the issue.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.