Today’s Market Trend

Analysis by Dr. Nancy Yamaguchi

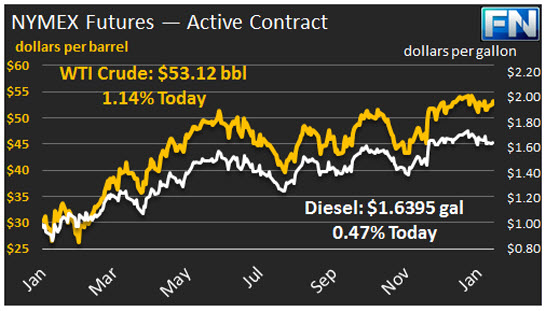

WTI crude prices have re-attained the $53/b mark this morning. WTI opened at $52.86/b today, a drop of $0.47 from yesterday’s opening price. Current prices are $53.12/b, $0.37 above yesterday’s close.

The U.S. Dollar Index has fallen by approximately 3% during the first three weeks of January. The Trump Administration has stated that the Dollar was too high, and the new Treasury Secretary nominee Steven Mnuchin stated that an “excessively strong dollar” could have a negative impact on the economy. U.S. policy is shifting toward protectionism and isolationism under the Trump Administration. Yesterday, on his first day in office, the new President signed an Executive Order withdrawing the U.S. from the Trans-Pacific Partnership (TPP.) The TPP’s goal was to liberalize trade between the U.S. and Pacific Rim countries, and to shift U.S. focus to the fast-growing Asia-Pacific region. It included 12 countries accounting for approximately 40% of the global economy. It was never submitted to Congress for ratification.

Distillate opened at $1.6303/gallon in today’s session. This was 0.58 cents below yesterday’s opening price. Current prices are $1.6395/gallon, a gain of 1.3 cents from yesterday’s close.

RBOB opened at $1.5747/gallon today, up 1.02 cents from yesterday’s opening. Prices are $1.59/gallon currently, a significant increase of 2.33 cents from yesterday’s close.

The EIA released its data on U.S. Retail Gasoline and Diesel Prices for the week ended January 23rd. Prices for both fuels declined at the national level. Details are presented in our second article today.

This article is part of Crude

Tagged: distillate, gasoline, u.s dollar, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.