Today’s Market Trend

Analysis by Dr. Nancy Yamaguchi

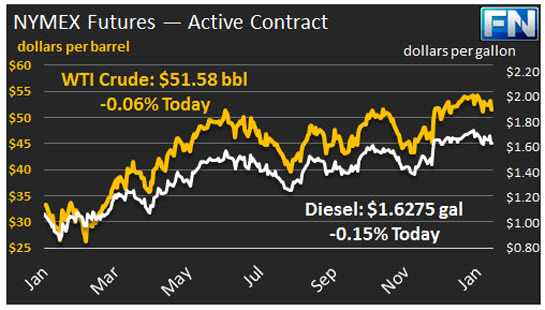

WTI crude prices have returned to the vicinity of $51.50/b after yesterday’s decline. WTI opened at $51.39/b today, a drop of $1.13 from yesterday’s opening price. Prices yesterday even dipped below $51/b for a time. Current prices are $51.58/b, $0.50 above yesterday’s close.

Yesterday’s downturn was in response to new forecasts of expanded crude supply, particularly from the U.S. The EIA released its estimate that crude production from the seven main shale plays will rise from 4707 kbpd in January 2017 to 4738 kbpd in February 2017, an increase of 41 kbpd. OPEC added another 23 kbpd to its forecast of year 2017 average U.S. production. OPEC now forecasts that U.S. production will be 13.7 mmbpd in 2017, versus 13.6 mmbpd in 2016. One year ago, in January 2016, OPEC estimated U.S. production at 13.9 mmbpd, and it forecast that production would fall to 13.5 mmbpd in 2016.

OPEC reported that it cut its December by 220.9 kbpd, dropping from 33,305 kbpd in November to 33,085 kbpd in December. The markets had a lukewarm response, since OPEC had noted that the U.S. increases could undo some of what the production cut intended to achieve. The IEA noted that it was too soon to assess the levels of OPEC compliance.

Today, the market awaits the EIA data on stocks. The API data showed a significant draw in crude inventories (5.042 mmbbls,) a major addition to gasoline stocks (9.751 mmbbls,) and a significant addition to distillate stocks (1.166 mmbbls.)

Distillate opened at $1.6199/gallon in today’s session. This was 2.87 cents below yesterday’s opening price. Current prices are $1.6275/gallon, up by 1.83 cents from yesterday’s close.

RBOB opened at $1.5416/gallon today, down 6.1 cents from yesterday’s opening. Prices slid to $1.5502/gallon today, up 0.15 cents from yesterday’s close.

This article is part of Daily Market News & Insights

Tagged: distillate, gasoline, prices, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.