Your Holiday Recap: What Did You Miss?

The holidays are a wonderful time to disengage from the cacophony of news and market changes, focusing instead on time with family and friends. With the holidays wrapping up now, there’s lots of news to catch up on, including the impacts of the recent winter storm, market fluctuations, tax changes, inventory data, and more. Today, we’ll recap what you may have missed while you were out.

Historic Winter Weather

The historic winter storm that hit the nation during the Christmas holiday is no surprise, but you may have missed the fuel supply impacts. Gulf Coast refiners were hit especially hard, causing regional utilization to fall 20%. Most PADD 3 refiners escaped long-term damage. Colorado’s only refinery was also shut off due to winter weather, with a restart not expected until later in Q1.

Market Fluctuations

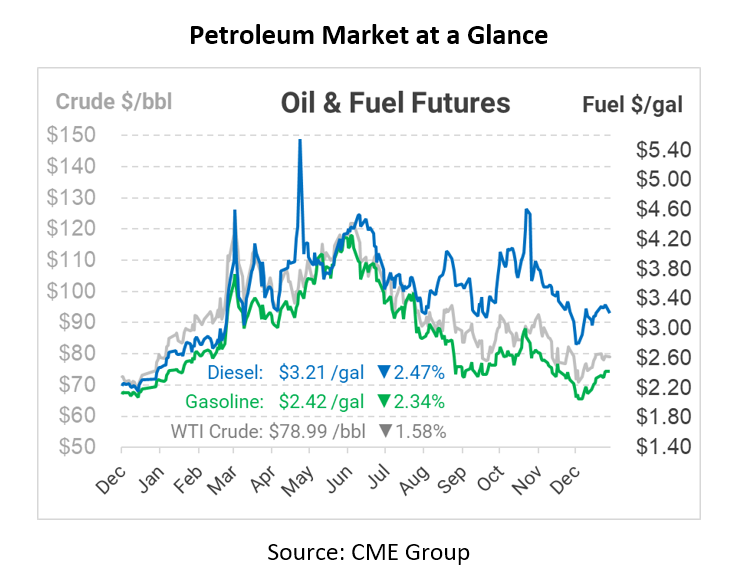

Markets saw some volatility over the holidays, with gasoline experiencing the biggest change. Gasoline and diesel both traded within a 30-cent range, steadily rising heading into the holiday season. Diesel and crude oil prices are showing signs of dropping, but gasoline remains elevated with prices still around $2.40 per gallon.

New Fuel Taxes and Fees

A new year means new taxes and fees for fuel. Washington state implemented a carbon tax-and-invest program, which will add two new fuel fees similar to California fuel markets, beginning this month. The Federal Government will be imposing a Superfund Excise Tax of $.164 per barrel on petroleum, equivalent to $.0039 for gasoline and diesel. Oil companies are also adjusting their California AB32 fees to adjust for new costs this year. For other tax changes this year in states including New York, Pennsylvania, Utah, Florida, and more, check out this article from the Tax Foundation and search “fuel”.

Mixed Inventory Data

Crude stocks rose slightly last week, but remain below the bottom of the five-year range. At just 25 million barrels, Cushing crude oil stocks (the delivery hub for WTI crude oil) are well below the seasonal average. Gasoline stocks fell by 3 million barrels, keeping them at the low-end of the 5-yr range. Diesel inventories continued their moderate improvements with a small 0.3 MMbbl build. Both diesel and gasoline stocks tend to rise in the first few weeks of the year, then shift to a downward pattern sometime around February. Keep an eye out to see if this trend holds true.

Keystone Pipeline

After a spill caused the Keystone Pipeline to shut down on December 9, operations were finally restored on December 29. The pipeline delivers crude oil from Canada down to refineries around Illinois and crude storage hubs in Cushing, OK. Only the line down to Cushing, OK was still offline heading into the holidays. With the restart, expect crude inventories in the critical storage hub to begin improving over the coming weeks.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.