Yesterday, Diesel Was $4.20. Now It’s $3.65. What Happened?

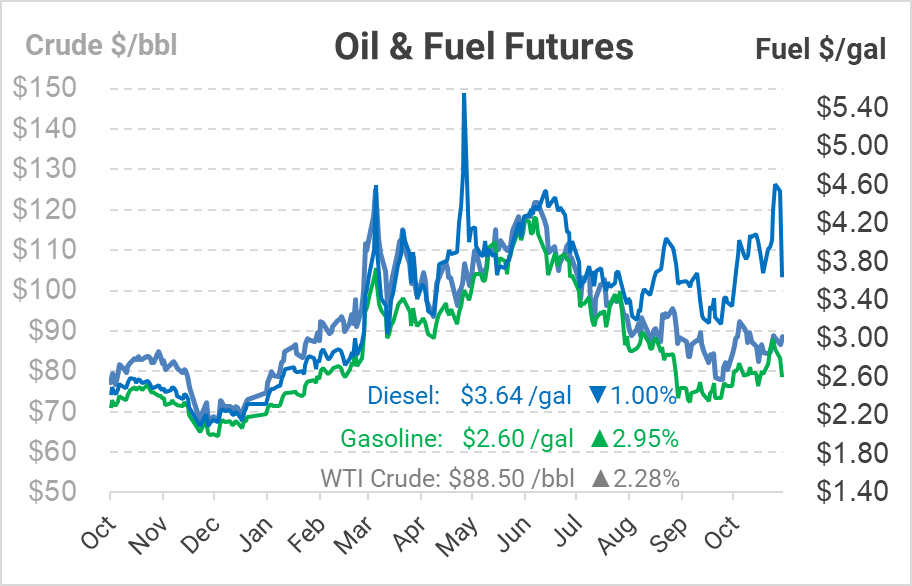

A new month makes a huge difference for futures markets. Diesel prices, trading based on the “prompt” November contract, settled near $4.20 yesterday. Today, as the market rolls to looking at December contracts, prices are over 50 cents lower. The lower prices today are good for consumers – it shows that markets currently expect supply conditions to improve somewhat in December.

In the past, we’ve covered the NYMEX and the forward curve structure called backwardation. Extreme backwardation is the cause of the huge, overnight diesel price change. Markets valued near-term supply far higher than supply in the future, bidding up the price of fuel delivered in November far above future values. So does the sudden drop in prices mean that everything is back to normal? Not necessarily.

We know the US has reduced diesel inventories currently. Headlines clearly stated that the US has lower inventories, leaving less of a buffer during supply/demand disruptions. It is worth clarifying that “25 Days of Supply” does not mean that the US will run out of diesel. As we covered yesterday, the most likely scenario is higher prices, with some sporadic local outages that get filled in by surrounding markets.

Still, the short answer to whether everything is back to normal is, no. The steep backwardation means anyone who bought product yesterday, with plans to deliver it this week, may have lost 50+ cents per gallon. That tells suppliers not to buy as much supply in the days leading into the end of the month, and instead wait until November 1. The result is less supply shipped in pipelines, inventory challenges, and reduced supply in some markets. Now that the new month has begun, markets will begin getting back to normal. But the backwardation for next month is already over 15 cents and could steepen as embargos on Russia tighten the market. We could see a recurring pattern in the next few months of supply tightening around the end of the month and early in the new month, then improving in the following days.

This article is part of Diesel

Tagged: Backwardation, diesel

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.