WTI Shatters $50 Price Floor, Economy to Blame

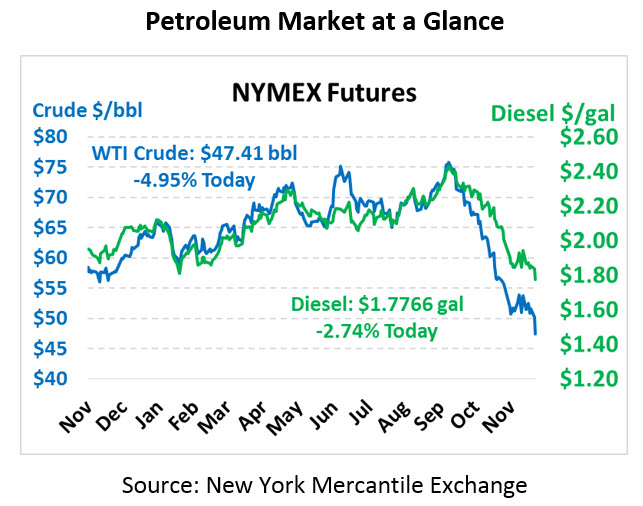

For the first time since October 2017, WTI crude oil settled below $50/bbl, with bearishness in equity markets spilling over to the commodities floor. Crude remains firmly bearish today – now that the $50/bbl floor has been breached, the automated trading strategies we’ve mentioned in the past are kicking in to sustain the sell-off. Still, the forecasts from the IEA, EIA, and OPEC shows a slightly oversupplied market in 2019 giving way to undersupply sometime in the year, so the fundamentals don’t support such low prices. Crude oil is currently trading at $47.41, down $2.47 (5.0%) from yesterday’s close.

Fuel prices are bearish as well today, though not quite so much as crude. Diesel breeched the $1.80/gal floor it had maintained, while gasoline is setting fresh annual lows. Diesel prices are currently trading at $1.7766, down 5.0 cents (2.7%). Gasoline prices are down to $1.3760, a price not seen since November 2016, after a loss of 3.4 cents (2.4%).

The stock market is uneasy leading up to Wednesday’s Federal Reserve meeting. Comments in past Fed reports have noted expectations to complete four separate rate hikes this year, and with three down, markets see a high likelihood of another hike announced tomorrow.

If the Fed does not hike rates tomorrow, markets might interpret the decision as meaning the economy is already running on fumes. The real question will be how many hikes are forecast for 2019 – if the number remains high, markets could continue panicking. A reduction in expected rate hikes next year could calm the market without setting off alarms that the market is already in trouble.

In the article below, we’ll explore how interest rates – and other economic trends – are weighing on oil prices, and what that means for 2019.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.