With WTI Over $50, Will Shale Producers Bite?

Oil prices are retreating after Friday’s lofty gains propelled the product above $52/bbl. WTI’s rally will be an interesting test for US shale producers, who made steep cuts in 2020 to stay in business. Normally, $50/bbl would be a tantalizing opportunity to layer in additional profitable production for the next year, spurring shale companies to continue expanding well counts and drilling activity. This year, though, shale companies are saying “pass.”

Strapped with large debts to pay off, shale producers will spend 2021 focused on raising profits and paying investors who stood with them through the downturn. Many producers have committed to restraint as prices climb higher, pointing out that high prices “tend to be a bit of a mirage,” as one CEO reported to Reuters. Most of the new drilling activity will be to offset declining output from aging wells.

The choices shale producers make now will have serious ramifications for global oil markets. In recent years, US shale has taken the role of global swing producer – opening taps when prices are high and tapping the brakes when prices fall. They’ve operated delicately with OPEC+, who is also trying to manage market prices. If US shale producers do hold back to focus on profits instead of revenue, it could allow OPEC+ to push prices higher while increasing their market share. But it’s a difficult balancing act – once shale producers have financially recovered from the downturn, they may return to a high-production strategy, causing markets to crash lower once again. We’re entering a new world for global oil, where both the US and OPEC+ will be working carefully to push prices to sustainable levels while fending off competitors trying to steal market share.

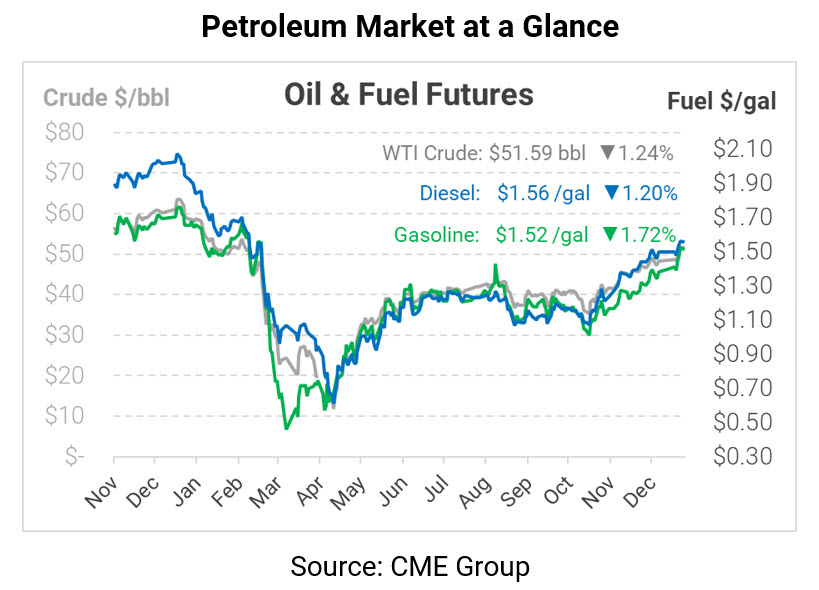

This morning, crude prices are moving lower as US Dollar gains and profit create headwinds. WTI crude is currently trading at $51.59, down 65 cents (-1.2%) since Friday’s closing price.

Fuel prices are also falling lower. Gasoline, which led the rally last week, is now seeing steeper losses. Gasoline is trading at $1.5157, down 2.7 cents (-1.7%). Diesel prices are $1.5606, down 1.9 cents (-1.2%).

This article is part of Daily Market News & Insights

Tagged: S Production, Shale

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.