With Markets Uncertain, Anything Goes

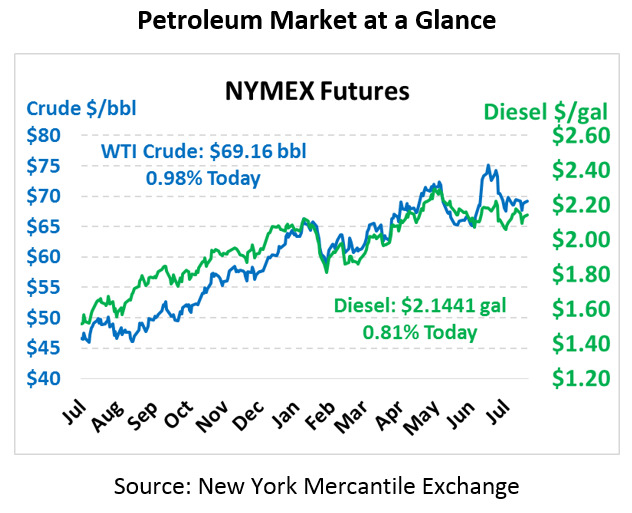

Oil markets are trending higher this morning as Iran sanctions are rearing their head, more details on that below. Crude oil ended in the positive on Friday, but gains were not enough to bring the week-end results into the black. All products ended the week in the red. This morning, crude prices are trading at $69.16, a gain of 67 cents (1.0%) over Friday’s close.

Fuel prices are aligned with crude this morning, each displaying moderate gains. Diesel prices are trading at $2.1441, up 1.7 cents (0.8%) from Friday’s close. Gasoline prices are trading at $2.0667, just barely edging higher with a 0.1 cent gain.

The trade is focused on Iran this morning, or more accurately on Washington’s stance on Iran. The first round of “snap back” sanctions were imposed today, targeting Iran’s financial industry, certain commodities, and its automotive and aviation sector. This initial volley of sanctions is more a warning than a direct blow to Iran’s economy, though these penalties will certainly have an effect. It gives the Trump administration a chance to show the seriousness of the sanctions and how strictly they’ll be enforced. Today’s sanctions pave the way for further penalties on oil production in November.

China has said they will not comply with the sanctions (especially in the face of a 25% tariffs on their goods shipped to the US) though they’ve stated they don’t plan to significantly increase imports. If China fails to comply with the sanctions, Iran could maintain enough oil sales to stabilize their economy, though at significantly reduced rates. Trump will have to balance Iran and China both if he’s going to successfully execute his foreign agenda (whatever that may be).

Traders Still Uncertain on Oil Stance

Last Friday brought the release of the CFTC’s weekly data, and the trend showed that trader sentiment has been roughly flat over the past three weeks. The blue line below represents net long positions (total trader commitment expecting prices to rise minus the commitment of those expecting prices to fall) by money managers (also called the “smart money”) in WTI crude. The green line shows WTI crude prices.

Market sentiment hit a record high in January 2018, and markets wondered whether crude oil could continue rising higher. Keep in mind that oil is driven by markets, not merely supply/demand – when most traders are already betting on prices to rise (therefore buying and holding their position), there aren’t many traders left to keep buying and pushing prices even higher. As such, the price dropped a bit in February as traders exited their positions. This occurred again in May/June as prices again peaked, prompting another round of profit-taking.

Today, we’re roughly 20% below that bullish high in January, yet prices are even higher now than they were back then! This speaks to several factors: First, whether consumers have or not, traders have acclimated to higher prices, so hitting $70 doesn’t have the same psychological appeal it used to have (meaning markets don’t feel that bullish drive they did a few months ago). Second, it means traders are directionally less excited about where prices are heading, so they’re cutting their bets and taking their profits (also bearish). However, it also means there’s more room to run if/when sentiment changes towards being bullish again. Twenty percent of the bullish bets have taken a break – if they come storming back quickly (whether due to Iran, or economic strength, or Trump tweeting something entirely new) we could easily see prices bid up rapidly to $75, $80 or even higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.