Winter Storm Pushes Fuel Prices Higher

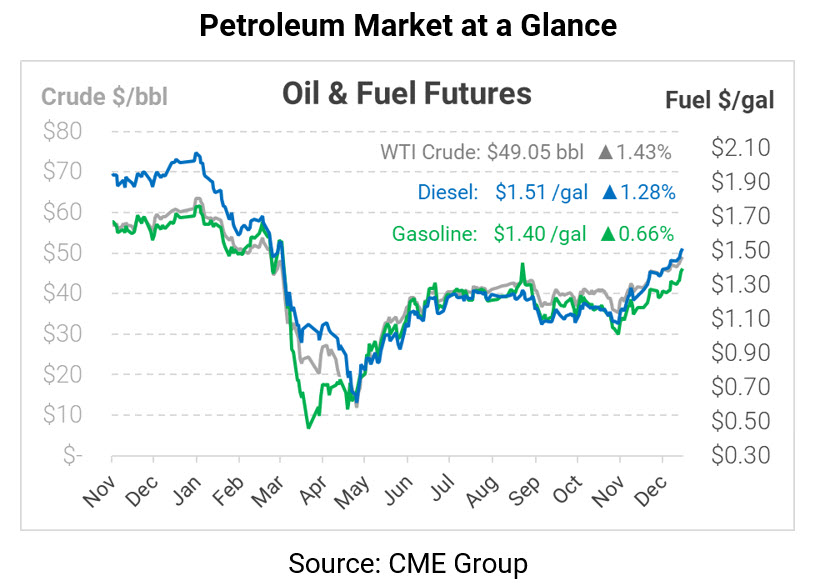

After a slowish morning, markets are roaring even higher this morning, with WTI crude now on the cusp of breaking the $50/bbl threshold. If the market can pull that off, it’d be the highest crude has traded since February 2020, before “COVID-19” became a household term.

Winter Storm Gail has now passed through the Northeast, bringing heavy snowfalls and winds. Although the storm has had minimal impact on most fueling infrastructure, the inclement weather did impact barge shipments. With limited local refining capacity, the Northeast relies on pipeline imports from the US Southeast and the Chicago region as well as barge shipments from Europe. With shipments delayed due to stormy weather, fuel prices in NY Harbor – the delivery point for NYMEX refined product contracts – did tick a bit higher. That dynamics partially explains why 3:2:1 crack spreads expanded above $11 this week for the first time in months.

The oil market continues moving higher this morning ahead of the next two holiday weeks. Crude oil is trading at $49.05 this morning, up 69 cents from Thursday’s closing price.

Fuel prices are also trading higher, though gasoline is lagging a bit behind the market. Diesel prices are trading at $1.5143, a 1.9 cent gain. Gasoline prices are currently $1.3972, up 0.9 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.