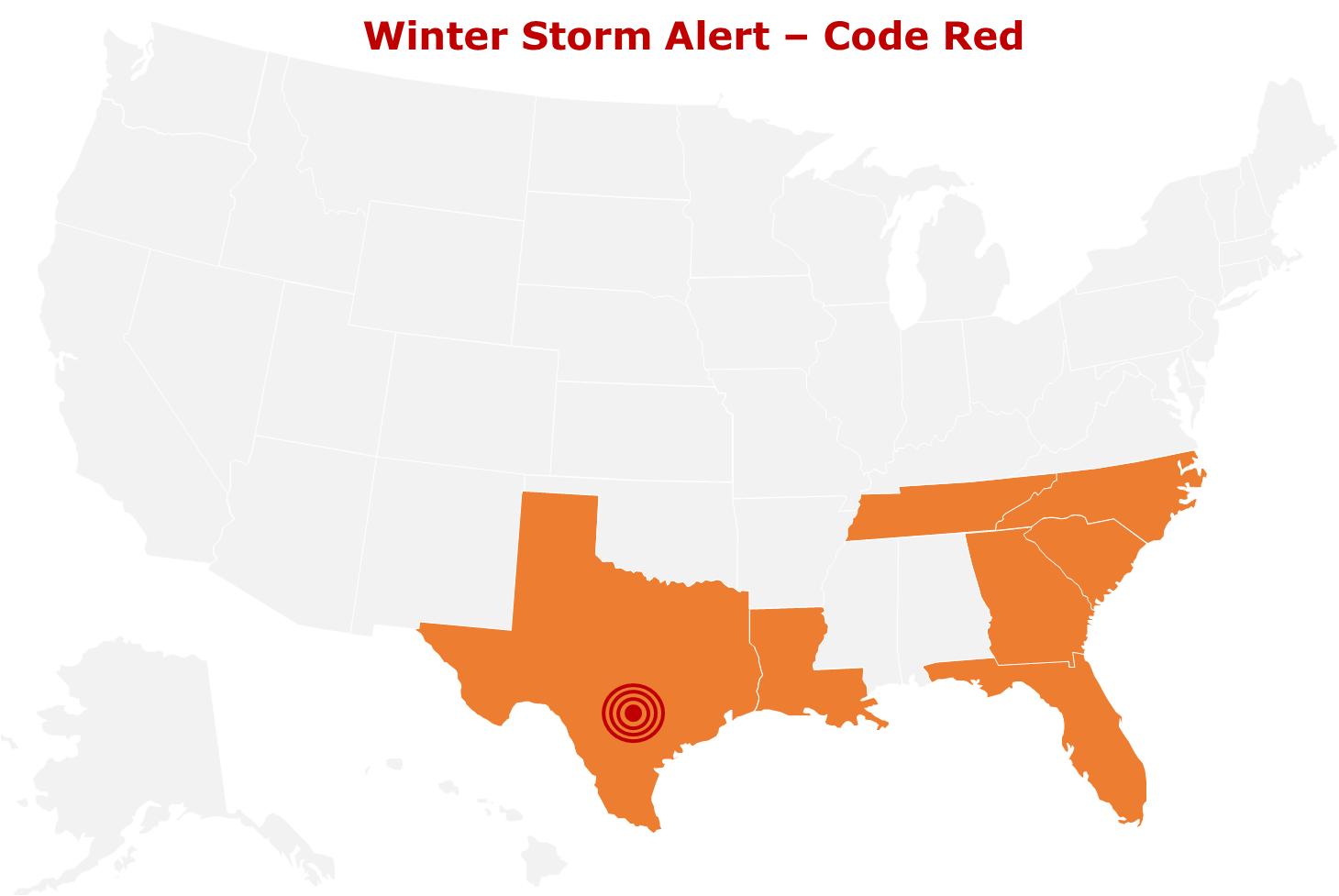

Winter Storm Alert – Code Red – March 19, 2021

As this week’s EIA oil report revealed, oil markets are beginning to show signs of normality. Although still far below typical, Gulf Coast refinery utilization rose from 60% to 70% this week, allowing markets to begin refueling.

Even with the increased supply, many markets are experiencing tightness. Backlogs of deliveries and continued terminal outages are straining carrier capacity in many places. In the Southeast, supply issues have grown in the Carolinas and Louisiana, causing long rack lines and delivery delays. Texas has improved significantly, though San Antonio remains a tough area.

Finally showing signs of improvement, most of Texas has been moved to Code Orange, though San Antonio and the surrounding region remain on Code Red until supply conditions strengthen. While there’s good news in Texas, other areas have seen logistics challenges return. Louisiana and North Carolina, which had been downgraded earlier in the week, are now back at Code Orange, joining Tennessee, Florida, South Carolina, and Georgia.

For new deliveries, Mansfield continues requesting 72-hour notice in Texas, Tennessee, and Florida. Mansfield is also asking for 48-hour lead times for deliveries in Louisiana, Georgia, North Carolina, and South Carolina.

This article is part of Alerts

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.