Will the US-China Talks Resume? Or US-Iran Talks?

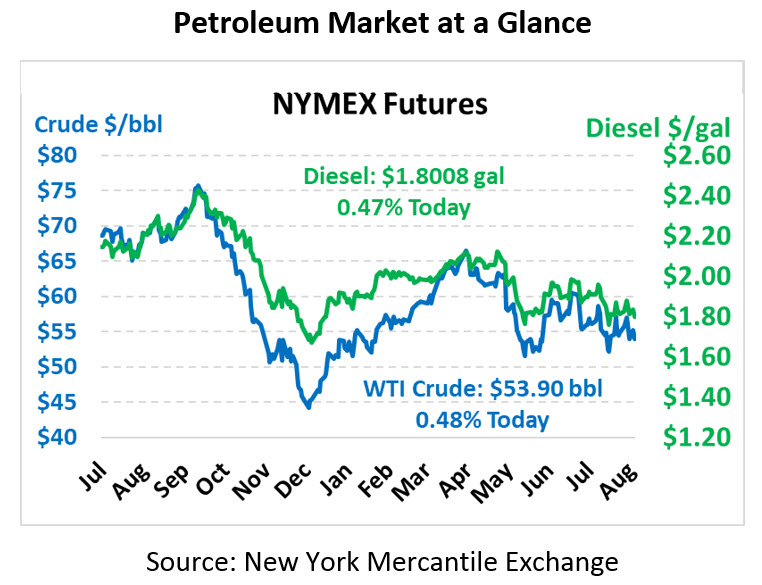

Oil prices ended yesterday with some fairly large losses despite early gains, with crude closing below $54 and diesel falling beneath $1.80 for the first time since early August. This morning, WTI crude is trading at $53.90, up 26 cents.

Fuel prices are also moving higher. Diesel prices are currently trading at $1.8008, up 0.8 cents from yesterday’s close. Gasoline prices are $1.6341, up 1.8 cents.

Positive sentiment (if you can call it that) between US and China is helping to lift the market. Trump said he believes China’s latest attempts at negotiations are “sincere”, meaning talks may resume. At this point, markets are just happy to see the countries continue talking, as on-going dialogue may at least avert further escalation. One of China’s largest oil companies, Sinopec, is reportedly seeking a waiver to exempt them from tariffs on US petroleum imports. If the waiver is granted, it could reinvigorate US oil relations with China and lead to a small boost in WTI crude prices.

Markets are still digesting the G7 Meeting which took place this weekend. The G7 is a gathering of some of the largest economies in the Western world, including Canada, France, Germany, Italy, Japan, the UK, and the US. A surprise appearance was made by Iranian Foreign Minister Zarif, who was invited by French President Macron. The appearance made the US-Iran conflict front-and-center on the global stage. Trump signaled that he would be willing to negotiate with Iran over their nuclear program under the right circumstances. If a US-Iran deal is reached (highly unlikely, since Iran won’t come to the table unless sanctions are lifted first), it would unleash Iran’s 2.5 MMbpd of export capacity onto the world again, causing prices to plummet.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.