Will Russia Abandon OPEC+ Deal?

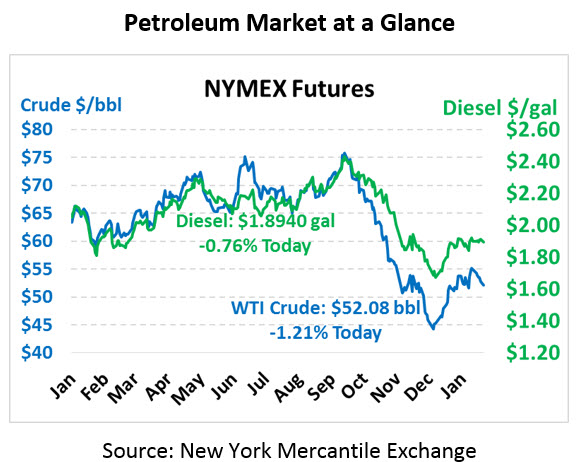

Today brings another sell-off in the petroleum market, as markets put their focus on US-China trade talks and OPEC production. Crude is trading at $52.08, down 64 cents.

Fuel is also trading lower with diesel prices this afternoon trading at $1.8940, down 1.5 cents. Gasoline prices are lower too, trading at $1.4195, down 2.7 cents.

This weekend the head of Russia’s main oil company, Rosneft, sent a letter to Russian President Vladimir Putin stating that OPEC+ production cuts are harming Russia’s market share and ceding ground to American producers. Given rivalry between the US and Russia, the letter will likely have an effect on Russia’s policy, especially given Russia’s relatively lower crude oil requirements. For instance, while Saudi Arabia needs $80/bbl for a stable government budget, Russia needs a much lower $40-$50 cost to stabilize its budget. If Russia breaks away from the OPEC+ production agreement and increases exports, prices could spiral lower as markets tip towards oversupply.

Venezuela remains under conflict, and their production continues declining. Without diluents, they cannot adequately refine their own crude oil, leading to fuel shortages within the country. The US and Russia are pursuing conflicting strategies within the UN; the US is seeking to formally recognize the National Assembly as the democratically legitimate governing body, while Russia’s proposal focuses on protecting Venezuela’s domestic sovereignty. Global powers are lining up in opposition to one another over Venezuela, making the issue more delicate from a national diplomacy standpoint.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.