Will Fuel Gains Continue? Exploring 3:2:1 Crack Spreads

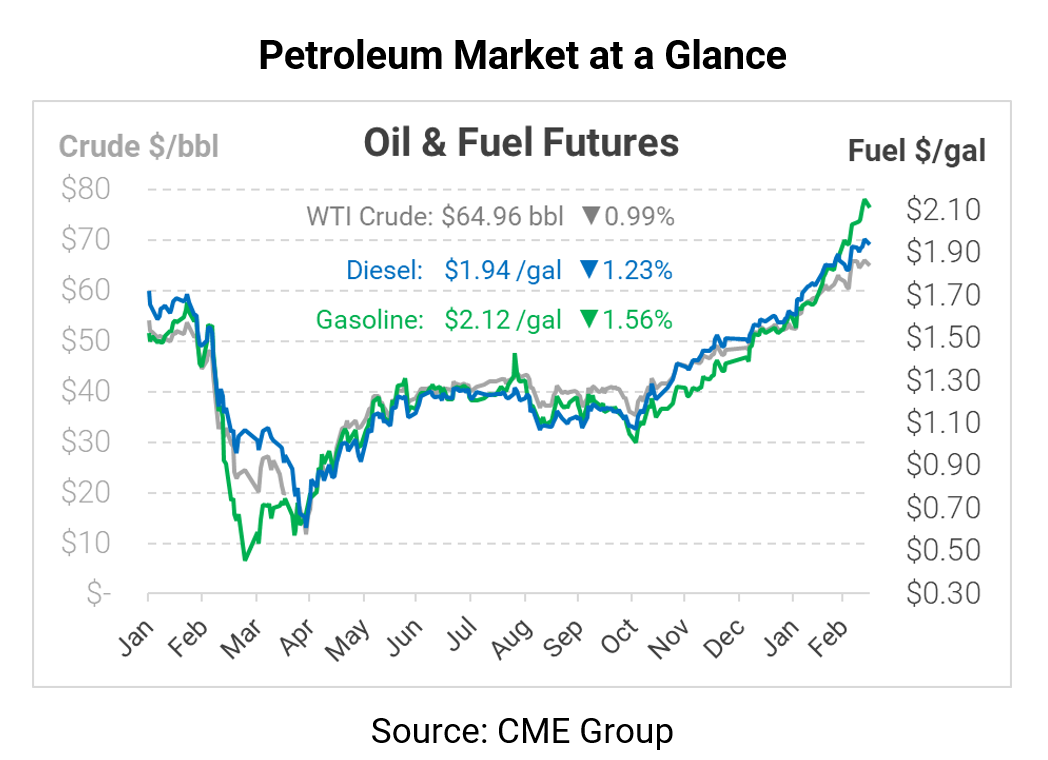

Markets are trading lower this morning, giving up some of the stimulus-related gains from last week. Despite positive economic data from China, continued supply cuts from Saudi Arabia, and a falling rig count in the US, traders aren’t feeling the enthusiasm so far. Despite today’s pullback, the overall trend has been higher prices, especially for fuel markets. Today, we’ll explore changes in the 3:2:1 crack spread and what it means for future fuel prices.

Fuel costs continue rising relative to crude oil. Crude oil prices have been on a tear, rising from $45/bbl up $65/bbl over the past three months, but fuel prices have risen even faster. The 3:2:1 crack spread, a rough calculation for a refiner’s margin from converting 3 barrels of crude oil into 2 barrels of gasoline and 1 barrel of diesel, is now more than $21/bbl. During most of 2020, spreads were below $10/bbl, so that represents a doubling from pandemic levels. Spreads tend to fluctuate between $11/bbl and $24/bbl, so current levels are not unusual. Still, fuel prices have not been this strong since mid-2019, well before the pandemic was on anyone’s radar.

A report from Wood Mackenzie shows that refiners remain hard-hit in Texas, especially in the Houston area. While refineries in some other cities have been able to restart more quickly, Houston refineries were offline well past February. Gulf refineries feed fuel to other regions of the country, so the prolonged outage has caused rolling shortages in different markets, particularly in the Southeast. The net effect of the outages has been elevated fuel prices, pushing the crack spread higher.

What’s to come for fuel prices? The old adage “what goes up, must come down” may apply. Generally, crack spreads only stay above $20/bbl for a few months at the most, falling back to earth in the fall/winter as gasoline demand cools. Some rallies experience even short life spans. At some point, the crack spread will fall back below $20/bbl, meaning something like 5-10 cent drops for diesel and gasoline prices relative to crude. But if crude oil is on the rise as some predict, it may not matter. So far, crude gains and crack spread hikes have combined to cause huge surges in fuel prices. If crude prices keep rising, even with lower crack spreads, it could mean more pain in the wallet.

Today’s Price Trends

The oil complex is pulling back this morning, retreating on profit-taking after a long and strong bull run. WTI is currently trading at $64.96, down 65 cents (-1%) from Friday’s closing price.

Fuel prices, which have risen faster than crude lately, or now falling faster than crude also. Diesel is trading at $1.9433, down 2.4 cents (-1.2%) from Friday. Gasoline prices are $2.1165, a loss of 3.4 cents (-1.6%).

This article is part of Daily Market News & Insights

Tagged: Crack Spreads, diesel, gasoline

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.