What’s Next for the Fuel Price Rally?

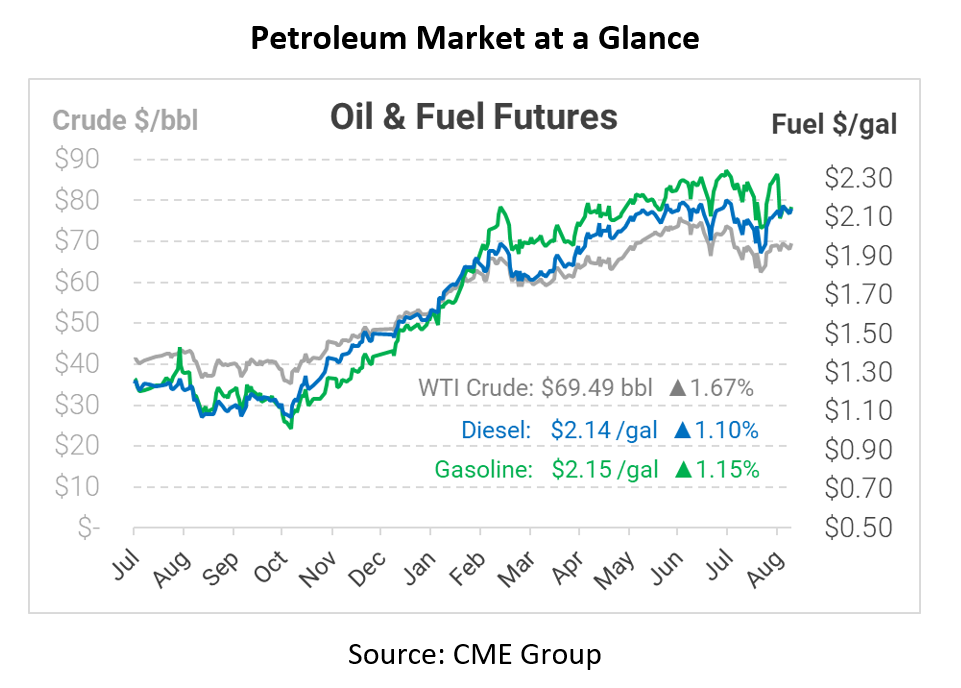

Markets are bouncing back this morning, continuing their recovery from late August’s selloff. Since hitting a low of $62/bbl on August 20, prices have been surging higher. Thus far, though, WTI crude has been unable to close above the $70/bbl threshold, coming as close as $69.99 before Labor Day. Fuel prices have also been on a roller coaster, with both gasoline and diesel falling 35 cents before recovering 20 cents.

The strong recovery since August 20 suggests that the oil rally is resilient, able to take a beating and still bounce back. With hedge funds taking a bullish slant once again, oil prices could continue rising farther, pushing through the $70/bbl threshold. Oil production outages could become a catalyst, with US production off by 1 million barrels per day due to Hurricane Ida and Libyan oil flows disrupted by protests.

Tomorrow’s inventory data will be instructive, providing a first glance at the impact of Hurricane Ida on fuel market fundamentals. Expect to see a sharp draw in petroleum products, since refiners have been offline for so long. Crude oil may end up a wash – Gulf production is down, but so are refinery crude intakes. Imports and exports have also been slowed at the same time. Markets are generally expecting the report to be bullish for fuel products and net neutral/bearish for crude oil, though anything is possible.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.