Western Leaders Meet Over Ukraine Crisis

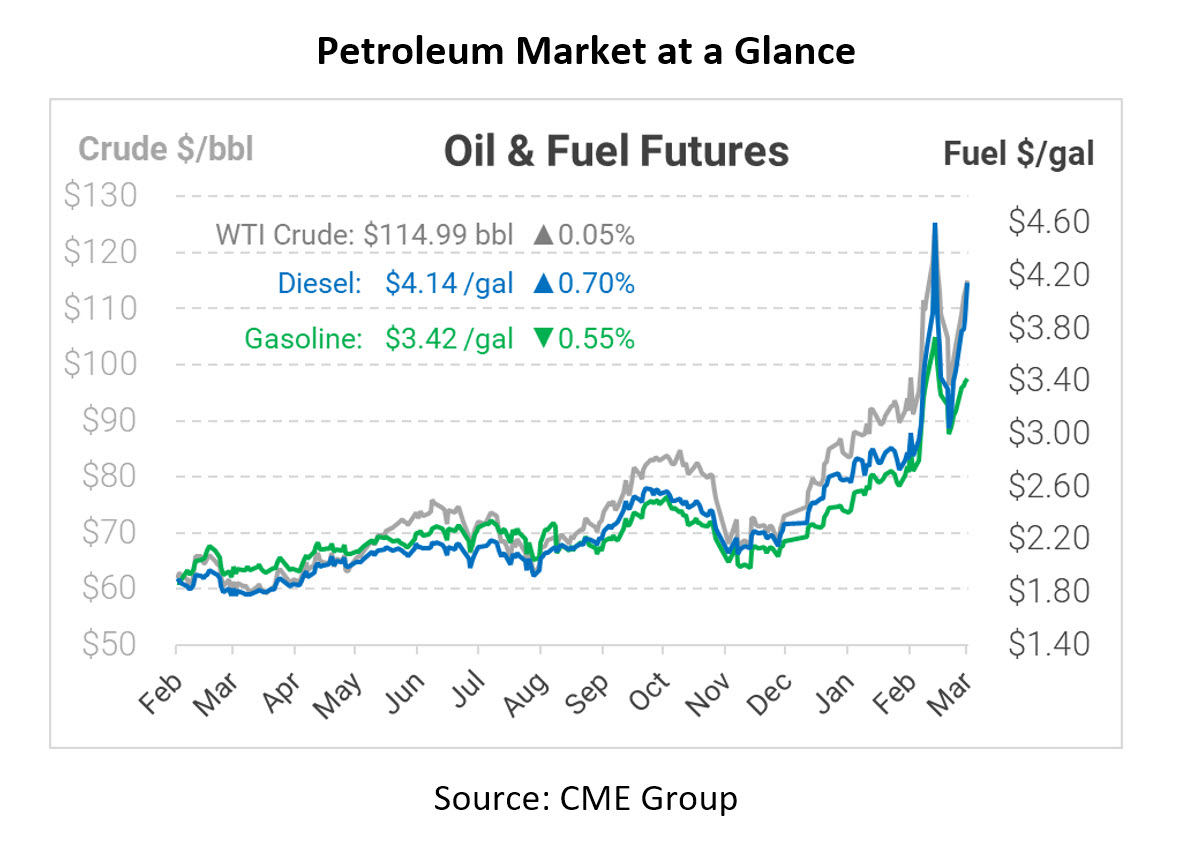

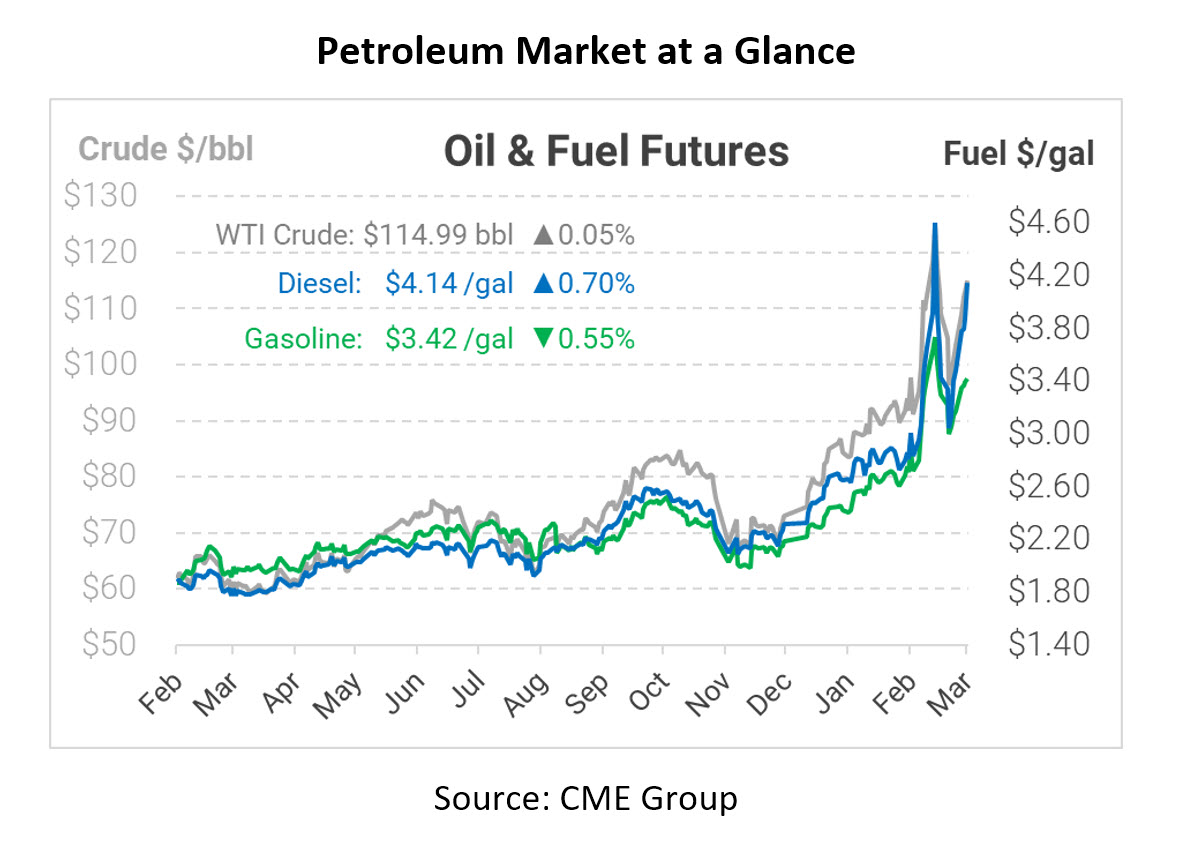

Today, oil prices are stable following an international summit of western leaders meeting on the Ukraine crisis to determine next steps. Three separate meetings of NATO, the EU, and the G7 revolved heavily around Russian sanctions, military aid, and additional pressure that could be applied. So far, markets aren’t perceiving much change for oil markets from the meeting.

Along with NATO leaders, President Biden met in Brussels for emergency talks today regarding Russia. With the invasion of Ukraine nearing the second month, both Biden and European ally leaders are debating the merits of new sanctions and additional aid for Ukraine. While new sanctions are unlikely to impact the oil industry, people still want to know precisely what these sanctions will do. Several European countries have vocally opposed broader energy sanctions, given the harsh economic impact on their economies. Countless European countries are heavily reliant on Russian energy products, and energy sanctions would not help the issue of rising prices around the world. Some leaders have suggested the possible complete oil embargo on Russia, but European countries such as Germany are heavily opposed.

Because they are less reliant on Russian oil, the United Kingdom and the United States have both added oil import sanctions on Russia for the time being. Even though the reliance on Russian oil pouring into the U.S. is less severe than Germany’s reliance, markets will likely remain tight as less oil makes its way into the supply chain. With crude oil in the Strategic Petroleum Reserves (SPR) falling to their lowest numbers since May 2002, markets will remain tight for the foreseeable future as the country tries to navigate the supply and demand issues. Slower Iranian deal talks also add to the market pressure, but some are still optimistic a deal will come sooner rather than later.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.