Weekly Summary

After giving up a significant portion of their Wednesday gains, oil prices are once again on the upward mend this morning as markets monitor chatter ahead of OPEC’s meeting on Sunday. Crude is currently trading at $71.11, a gain of 79 cents since yesterday’s close.

Fuel prices are heading towards higher ground as well, propelled by higher crude numbers. Diesel prices are currently $2.2389, an increase of 1.1 cents. Gasoline prices are $2.0303, a larger increase of 1.6 cents.

Markets are watching for any indicative statements from OPEC on expected outcomes for Sunday’s meeting. OPEC is expected to discuss declining production caused by sanctions on Iran and political instability in Venezuela. Trump has been actively tweeting @OPEC, telling the group they should lower prices given America’s protective operations in the Middle East.

Storm Update

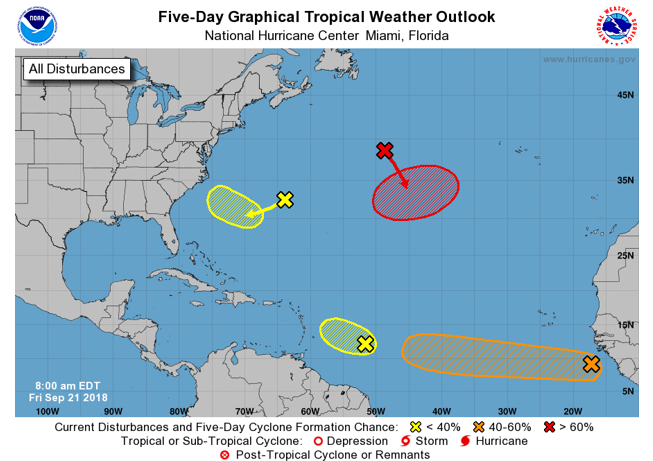

Conditions in North Carolina have improved considerably over the week, though certain areas remain affected by flooding. Mansfield has moved to Code Orange for North Carolina, indicating improving carrier capacity. While the Carolinas are beginning recovery efforts, the Atlantic is gearing up for another bout of activity. Some of Florence’s remnants are looping around and show a 20% chance of re-forming into a tropical storm. Even if the system does not reach tropical storm level, North Carolina will certainly be watching the system closely to see if it will bring any additional rain to flooded areas.

Lower in the Atlantic, two storm systems show potential to develop into storms. One system (Invest 97L) approaching the Lesser Antilles shows a 10% chance of formation over the next five days given unfavorable conditions for storm development. Off the Coast of Africa, Invest 99L shows a high probability of strengthening into a Tropical Storm over the next few days, though its ultimate track cannot be accurately predicted at this time.

Week in Review

It’s been a busy week for oil prices, though the general trend has been towards higher prices after last week’s pre-Florence dip. It’s unlikely the storm has had any significant impact on national oil prices; no major refineries operate in the Carolinas and the two pipelines running through the state – Colonial and Plantation – did not suffer any operational setbacks.

This week’s price activity was partially a response to reports that Iran’s exports have been reduced by 30%, which caused Brent (international) prices to rise more quickly early in the week than WTI (American) oil prices did. Because Europe is more reliant on Middle Eastern crude than the US, they see prices rise more quickly when Iran’s production is taken offline. As we move towards November when sanctions go into full effect, markets expect supplies to become even tighter, using up spare capacity and leaving global prices more vulnerable to unexpected supply outages.

A bullish EIA report also helped propel prices upward, particular given the draw in Cushing, OK inventories – the delivery point for WTI crude. While Cushing stocks don’t impact international oil trends, they have a significant impact on American prices, leading the Brent-WTI spreads to fall from early week highs well over $9 to less than $8 at Thursday’s close.

Price Review

Crude oil has had a bumpy week, rising clumsily from an opening price of $68.93 to a high of $71.81 on Thursday. Friday’s trading may see prices bump even higher than that level. The week saw prices increase rapidly following a number of key reports including the API’s inventory report and the EIA’s weekly report, though Thursday brought a steep break from the overall trend. Prices opened Friday morning at $70.20, a gain of $1.27 (1.8%) for the week.

Like crude, gasoline saw a huge jump on Tuesday to start the week, with steady gains continuing on Wednesday. By Thursday prices fell off somewhat, but by a much smaller margin can crude did. Friday morning has brought another surge in prices. Gasoline opened the week at $1.9699, the lowest price of the week, and they have not looked back since. Friday’s opening price was $2.0163, a gain of 4.6 cents (2.4%).

Diesel prices looked much closer to gasoline prices than to crude, though with bigger swings each day. Diesel opened the week at $2.2122, significantly higher than gasoline prices now that summer gasoline season is over. The two fuels tracked each other for most of the week, but Thursday brought somewhat steeper losses for diesel. Friday’s opening price of $2.2301 represents just a 1.8 cent (0.8%) gain.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.