Mid-Week Snapshot

Have an article worth sharing? Send it to FUELSNews@mansfieldoil.com, and we’ll share it next week in our Weekly Summary segment.

OPEC Likely to Agree to Production Increase Next Week

According to a Bloomberg study, the majority of traders expect OPEC to push past disagreements and agree to at least some form of production increase. Their original agreement made in 2016 cut production by 1.8 million barrels per day, but changes in Venezuelan production led total OPEC output lower by about 2.4 million barrels per day. The market consensus shows a production increase of 500,000 barrels per day across member organizations, which would come just shy of returning total OPEC output to its expected levels for 2018. Click Here to read more from Bloomberg.

Surprising Global Event to Cause Low Trading Volumes

We’ve noted before in FUELSNews that markets are subject to the whims of traders, not always responding directly to fundamentals like supply and demand. A recent Reuters article highlighting the trade volume dampening effects of a surprising event show how bizarre the market can be at times. This event corresponds with a 40% decrease in stock market volumes in the U.S., and steeper decreases elsewhere in the world. What could cause such a notable market impact? The World Cup. Click Here to read more from Reuters.

OPEC Supply Increase Would Cause Lower Prices, Higher Volatility

If OPEC does choose to increase their oil production, the impact on markets would be lower prices, but it could also increase volatility. More steady production from OPEC would decrease spare capacity down to 2 million barrels per day. During a production outage from say, a militant attack in the Middle East or a pipeline outage in Europe, there would be less available excess production to fill the gap, causing prices to swing higher during outages. Click Here to read more from Reuters.

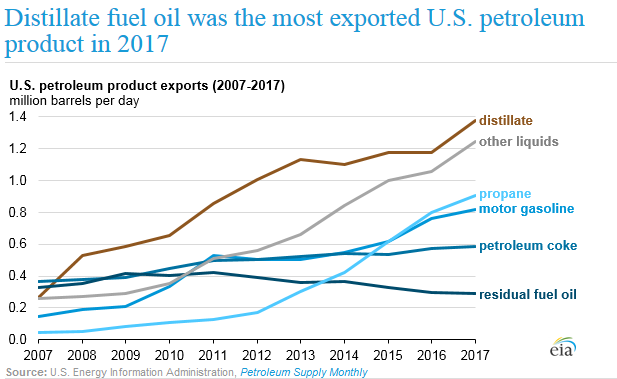

Diesel Fuel was the Most Exported U.S. Petroleum Product in 2017

According to the EIA, distillate fuel oil, or diesel fuel, was the largest category of petroleum products exported in 2017. More than a quarter of all distillates produced in the U.S. last year were exported to other countries, predominantly to Mexico and South America. Diesel exports are an important statistic because even if domestic consumption remains flat, diesel exports can create a draw on diesel that leaves domestic inventories low, causing higher prices. Click Here to read more from the EIA.

Driver Turnover Rises in Q1 2018

According to analysis from the American Trucking Association, driver turnover for large trucking companies rose to an annualized rate of 94% in Q1 2018. The increase represents a 20 percentage point increase from Q1 2017. For smaller carriers the turnover rate fells slightly, down to 73%. Click Here to read more from the ATA.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.