Weekly Price Review

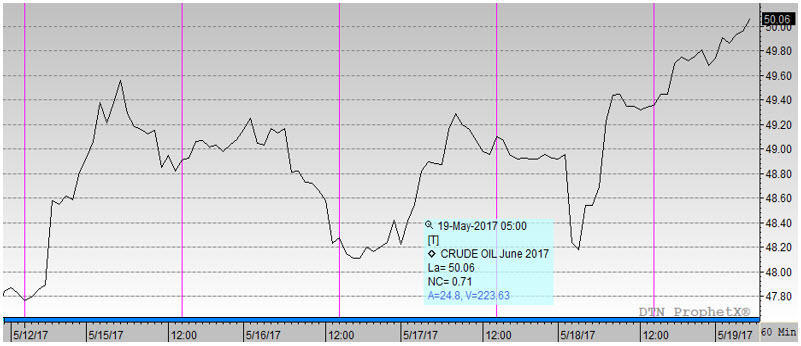

Crude prices this week had several sharp up-down cycles caused by supply-demand headlines and worsening political turmoil. Overnight and early morning trading finds the market in the midst of a strong rally, and WTI has regained the $50/b level. WTI opened at $49.28/b today, an increase of $0.35, or 0.72%, above yesterday’s opening price. Current prices are $50.10/b, $0.75 above yesterday’s closing price. The week appears to be heading for an end in the black after posting losses in the last three weeks.

WTI crude prices opened the week at $47.85/b. WTI opened this session at $49.28/b, an increase of $1.43, or 3.0%, from Monday’s opening. During the week, prices ranged from a low of $47.75/b on Monday to a high of $50.10 on Friday, a range of $2.35. Current WTI prices are $50.10/b, $0.75 above yesterday’s closing price.

Diesel prices opened Monday at $1.4933/gallon. Diesel opened this morning at $1.5433/gallon, an increase of 3.3%, or 5.0 cents, for the week. Prices ranged from a low of $1.4897/gallon on Monday to a high of $1.5695/gallon on Friday, a price range of 7.98 cents. Current prices are $1.5691/gallon, a jump of 2.38 cents from yesterday’s closing price.

Gasoline prices opened Monday at $1.5785/gallon. Gasoline opened today at $1.6073/gallon, an increase of 1.8%, or 2.88 cents, for the week. Prices ranged from a low of $1.5597/gallon on Thursday to a high of $1.6279/gallon on Friday, a range of 6.82 cents. Prices are $1.6263/gallon currently, a significant increase of 2.0 cents from yesterday’s close.

Prices have been volatile this week. Supply-demand fundamentals improved by the second half of the week, but the price response was muted. It appeared that political turbulence surrounding the Trump Administration caused risk-off sentiment in the markets. This spread internationally with news possibly connecting Brazil’s President with a bribery scandal. The Dow Jones Industrial Average fell approximately 344 points between Monday’s market opening and Thursday’s market opening. The Justice Department appointed ex-FBI Director Robert Mueller as special counsel to oversee the investigation into the Russia issues, and this choice appeared to calm markets.

The stock movements this week were constructive. The Energy Information Administration (EIA) reported across-the-board inventory drawdowns for the second week in a row—and the only two times this has happened all year. The EIA reported drawdowns of 1.753 mmbbls crude, 1.944 mmbbls diesel, and 0.413 mmbbls gasoline. This helped reverse Tuesday’s price downturn, which began when the API data reportedly showed additions to crude and diesel inventories.

U.S. crude inventories have now decreased for six weeks running. This is a major turnaround from the first quarter, when stockpiles grew every week except for one. During the first quarter of 2017, crude inventories expanded by 52.4 mmbbls. In contrast, during the second quarter to date (through the week ended May 12th,) stockpiles have been reduced by 12.6 mmbbls.

The drawdown in crude inventories is consistent with rising refinery runs. Refineries are finishing spring maintenance and are ramping up for summer. Refinery crude inputs have risen from 15492 kbpd during the first week of March to 17122 kbpd during the week ended May 12th, an increase of 1630 kbpd.

Moreover, U.S. crude production dipped by 9 kbpd during the week ended May 12th. This broke a streak of twelve weeks with production increases.

Although U.S. total product demand declined during the week, demand for the key fuels gasoline, jet fuel and diesel crept up.

The market is increasingly confident that the OPEC-NOPEC production cuts will be extended, most likely for nine months instead of the originally proposed six. The formal meeting is scheduled for May 25th, but OPEC members are already in meetings to discuss market scenarios. The group is considering not only an extension, but the possibility of a deeper cut. Russia has shown greater commitment to the cuts also.

This article is part of Uncategorized

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.