Weekly Price Review

Crude prices this week languished on Monday and Tuesday, then began a strong recovery Wednesday through today. WTI opened at $47.81/b today, an increase of $0.42, or 0.89%, above yesterday’s opening price. The week appears to be heading for an end in the black after posting losses in the last three weeks.

WTI crude prices opened the week at $46.35/b. WTI opened this session at $47.81/b, an increase of $1.46, or 3.1%, from Monday’s opening. During the week, prices ranged from a low of $45.43/b on Tuesday to a high of $48.22 on Thursday, a range of $2.69. Current WTI prices are $47.83/b, unchanged from yesterday’s closing price. Despite the recent price recovery, crude prices remain at their November 2016 levels, prior to OPEC making its historic production cut deal. Since April 12th, WTI crude prices have opened lower in thirteen of the last twenty-one trading sessions, falling by 10% ($5.59/b) since then.

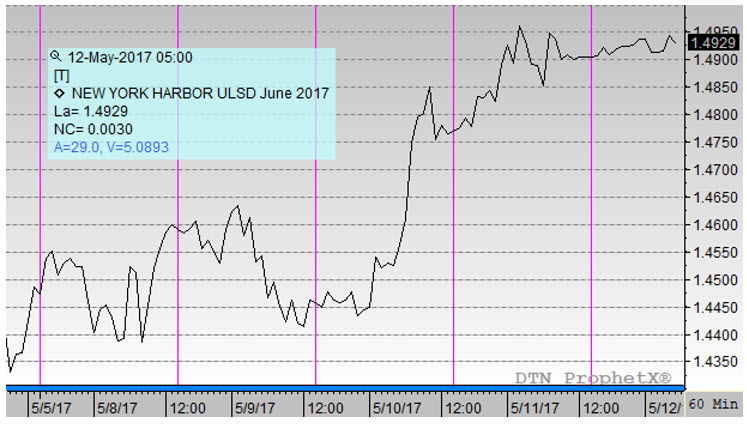

Diesel prices opened Monday at $1.4465/gallon. Diesel opened this morning at $1.49/gallon, an increase of 3.0%, or 4.35 cents, for the week. Prices ranged from a low of $1.4316/gallon on Monday to a high of $1.4981/gallon on Thursday, a price range of 6.65 cents. Current prices are $1.4939/gallon, up slightly by 0.4 cents from yesterday’s closing price. Diesel prices have opened lower in sixteen of the last twenty-one trading sessions, shedding 16.45 cents, or 9.9%, since April 12th. Like crude, diesel prices are at their lowest point since November.

Gasoline prices opened Monday at $1.5065/gallon. Gasoline opened today at $1.567/gallon, an increase of 4.0%, or 6.05 cents, for the week. Prices ranged from a low of $1.4805/gallon on Wednesday to a high of $1.5709/gallon on Thursday, a range of 9.04 cents. Prices are $1.5753/gallon currently, up 1.31 cents from yesterday’s close. Gasoline prices have opened lower in fifteen of the last twenty-one trading sessions, dropping by a total of 19.69 cents, or 11.2%, since April 12th.

This week, the outlook for a coming supply-demand balance was pushed back further when the Energy Information Administration (EIA) released its Short-Term Energy Outlook (STEO.) The STEO updated its forecast of global oil demand upward by approximately 144 kbpd for 2017. However, it also revised upward its forecast of oil supply by 220 kbpd, thereby widening the supply overhang. U.S. crude production is now forecast to average 9.3 mmbpd in 2017, versus 8.9 mmbpd in 2016.

The STEO cut its Brent crude spot price forecast by one dollar, to average $53/b in 2017, down from $54/b in the April STEO, and $57/b in 2018, unchanged from the April STEO. WTI prices are forecast to average $2/b lower than Brent prices in both years, $52/b in 2017 and $55/b in 2018.

The bearish impact of this news was moderated somewhat by API data showing a drawdown in crude and diesel stocks. However, the API data showed a significant build in gasoline inventories of 3.2 mmbbls. This held gasoline down relative to crude and diesel.

Market sentiment grew more confident upon the release of the EIA’s weekly supply data on Wednesday. The EIA reported across-the-board inventory drawdowns: 5.247 mmbbls of crude, 0.15 mmbbls of gasoline, and 1.587 mmbbls of distillate.

The OPEC-NOPEC production cut agreement received a boost yesterday when Turkmenistan indicated that it might join in the cut agreement. The market believes there is a high probability that the group will decide to extend the cuts beyond the originally planned June 30 end date.

Concerns remain about the persistent oversupply nonetheless. Libyan output reportedly has risen to 800 kbpd for the first time since 2014, for example, and the National Oil Company (NOC) has stated that production could rise as high as 1.0-1.2 mmbpd if peaceful conditions prevail. Libya is not part of the OPEC production cut agreement.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.