Weekly Price Review

Crude prices this week continued on a downward path this week, punctuated by a sharp downward price movement on Thursday that hit the bottom at $45.29/b, then another collapse overnight on Friday that sent prices as low as $43.76/b. Prices have collapsed through some key technical supports, motivating heavy technical selling. Moreover, some analysts and investment houses are beginning to express doubts that the OPEC-NOPEC cuts will achieve their goals. WTI opened at $45.51/b today, a major drop of $2.09, or 4.39%, below yesterday’s opening price. The week is heading to another ending in the red again.

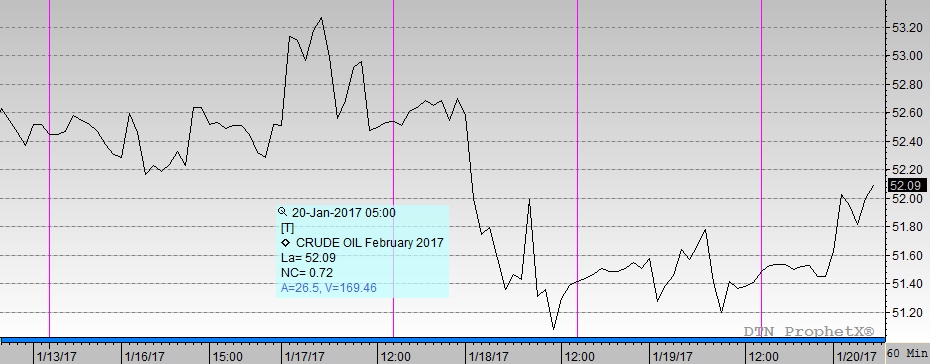

WTI crude prices opened the week at $49.17/b. WTI opened this session at $45.51/b, a major collapse of $3.66, or 7.4%, from Monday’s opening. During the week, prices ranged from a low of $43.76/b on Friday to a high of $49.32 on Monday, a range of $5.56. Current WTI prices are $45.23/b, down $0.29 below yesterday’s closing price. Crude prices have retreated to where they were in November, prior to OPEC making its historic production cut deal. WTI crude prices have opened lower in twelve of the last sixteen trading sessions, falling by 14.8% ($7.89/b) since April 12th

Diesel prices opened Monday at $1.5062/gallon. Diesel opened this morning at $1.4114/gallon, a major drop of 6.3%, or 9.48 cents, for the week. Prices ranged from a low of $1.3748/gallon on Friday to a high of $1.5109/gallon on Monday, a very wide price range of 13.61 cents. Current prices are $1.4139/gallon, up slightly by 0.16 cents from yesterday’s closing price. Diesel prices have opened lower for fourteen of the last sixteen trading sessions, dropping by 24.31 cents, or 14.7%, since April 12th. Diesel prices are at their lowest point since mid-November.

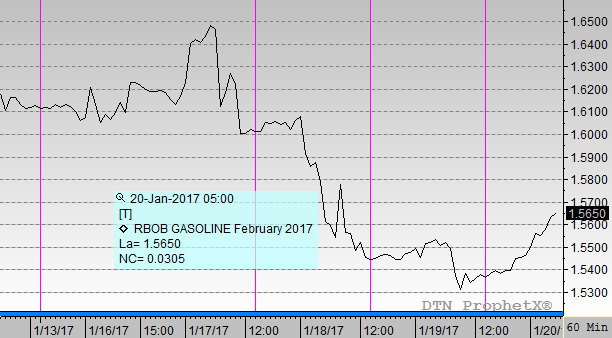

Gasoline prices opened Monday at $1.5481/gallon. Gasoline opened today at $1.4825/gallon, a large drop of 4.2%, or 6.56 cents, for the week. Prices ranged from a low of $1.450/gallon on Friday to a high of $1.5831/gallon on Tuesday, a very wide range of 13.31 cents. Prices are $1.4789/gallon currently, a decrease of 0.23 cents from yesterday’s close. Gasoline prices have opened lower in fifteen of the last sixteen trading sessions, dropping by a total of 28.14 cents, or 16.0%, since April 12th.

This week, several national and global indicators appeared to worsen the outlook for a coming supply-demand balance. The market had been expecting significant across-the-board drawdowns in U.S. crude, diesel, and gasoline inventories, for example, but the results were miniscule draws on crude and diesel and a small build in gasoline. U.S. crude production continued to rise, adding another 28 kbpd to supply. Apparent demand for middle distillates rose significantly, but gasoline demand declined.

The OPEC-NOPEC production cut agreement, and its potential extension, has been one of the only market forces supporting prices, yet this week the compliance rate was revised down slightly, to 90% from 92%. The production cut agreement is now in its fifth month, and there is a wide range of opinion as to how effective the cuts will be, whether they will be extended through the end of the year, and if so, whether the extension will be sufficient to move the market into a better balance.

Also in OPEC news, Libya’s Sharara oilfield resumed production, adding some 200 kbpd to the market. Libya is not a participant in the production cut agreement, and it was understood that Libyan crude production could vary widely. But it is now possible that a more lasting peace will allow crude production and exports to grow. This week, in a surprise move, the leaders of the two rival governments met in the UAE and held what were called “breakthrough” talks that have the potential to end years of internal strife. Fayez al-Sarraj is the head of the official UN-backed government known as the Government of National Accord (GNA.) The key military opponent is General Khalifa Haftar, who heads the self-declared Libyan National Army and leads a competing administration. The two parties reportedly agreed in principle to hold elections in 2018 and to a power-sharing deal.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.