Weekly Price Review

By Dr. Nancy Yamaguchi

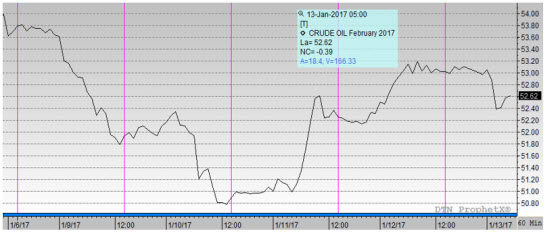

Oil prices opened at a very strong $53.75 on Monday, but this was followed by a sharp downward correction. WTI prices shed 5.5% over the next two days, opening at $50.81/b on Wednesday. Some observers believed that the sell-off was an expected downward correction, getting prices back down into the $51-$52 range rather than the $53-$54 range. The rest of the week saw prices gradually creeping back up above $53/b. Today’s trade is lackluster so far, and the week may end in the red.

Several factors also pointed to expanding crude supply: Another increase in the U.S. active oil rig count, forecasts calling for a larger increase in U.S. output in 2017, Iran’s sale of approximately 14 mmbbls of crude from floating storage, Libya’s announcement of a significant rise in output, and a planned sale of 8 mmbbls of light sweet crude from the U.S. Strategic Petroleum Reserve.

It was later announced that the SPR sale would be offered for March-April delivery, which removed some of the bullish supply pressure. Prices began to climb again on news that Saudi Arabia was meeting its production cut pledge. A number of Asian customers were informed that their supplies would be reduced in February. While company-specific data has not been released, Bloomberg noted two Southeast Asian refiners who had supplies cut by about 30% and one Indian refiner who had supplies cut by 20%.

The EIA reported a massive buildup of inventories: 4.097 mmbbls crude, 5.023 mmbbls gasoline, and a whopping 8.356 mmbbls distillate. The bearish impact was moderated apparently by year-end vagaries concerning tax strategies and by weather issues that created a short-term jump in imports.

WTI crude prices opened at $53.05/b this morning, a 1.3% decrease from Monday’s opening of $53.75/b. Prices ranged from a high of $53.83/b on Monday to a low of $50.71 on Tuesday. This is a range of $3.12. WTI prices are $52.64/b this morning, $0.41 below opening. Prices are hovering under $53/b.

Distillate prices opened Monday at $1.7011/gallon. They opened this morning at $1.6758/gallon, a drop of 1.5% (2.53 cents) for the week. Prices ranged from a low of $1.6064/gallon on Wednesday to a high of $1.7031/gallon on Monday, a very large range of 9.697 cents. Prices are currently $1.6626/gallon, 1.3 cents below Thursday’s close.

Gasoline RBOB prices opened Monday at $1.6297/gallon. Today’s opening price of $1.6158/gallon was a drop of 0.9%, or 1.39 cents, for the week. Prices ranged from a low of $1.541/gallon on Tuesday to a high of $1.6337/gallon on Monday and Thursday, a wide range of 9.27 cents. Prices are $1.6082/gallon currently, 0.26 cents below Thursday’s close.

This article is part of Uncategorized

Tagged: distillate, gasoline, prices, U.S., wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.