Weekly Price Review

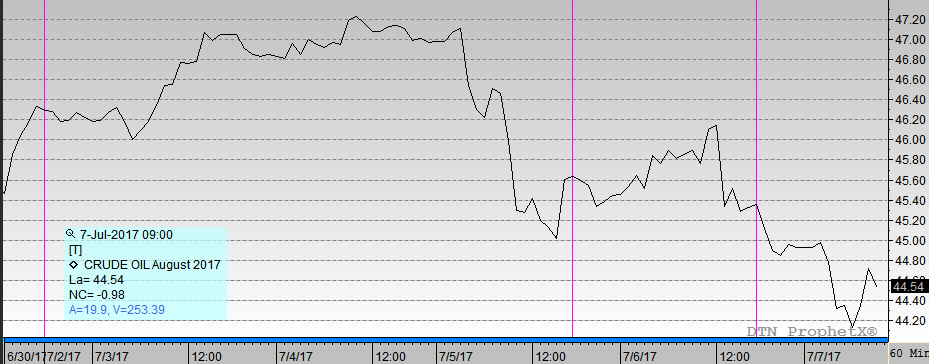

Fuel prices had a bumpy week, opening the week at $46.28/bbl on Monday, rising as high as $47.32 on Wednesday, and falling to open on Friday at just $45.35, ending the week in the red. Markets are falling rapidly on Friday morning, and have reached lows of $44.05 as of the time of writing. After several straight weeks of falling prices, prices rose last week; it appears that this week continues the trend of falling prices.

Fundamentally, this week gave several signs that should have boosted markets. Baker Hughes reported that the US rig count declined after a 23-week streak of additions, signaling a potential slowing of U.S. production. Inventories also posted across-the-board stock draws, bringing crude inventories down by 6 MMbbls and gasoline and diesel inventories down by 3.7 MMbbls and 2.1 MMbbls, respectively. While prices did make some positive movement immediately following these announcements, any upward pressure was quickly squashed.

While fundamentals were bullish, the news this week has been bearish. Russia has repeatedly stated that they would not consider deepening production cuts to boost prices, saying that it would send the wrong signal to the market. OPEC production rates in June have buoyed to the highest they’ve been in 2017, rising 500 kbpd higher than May levels.

Markets are struggling to rise amid higher global oil production. Even strongly bullish reports are failing to move prices back to the $50 level seen earlier this year. Absent a major announcement that fundamentally changes the market’s outlook, it appears that sub-$50 prices (and subsequently low diesel and gasoline prices) will remain for a while.

This article is part of Crude

Tagged: Weekly Prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.