Weekly Price Review

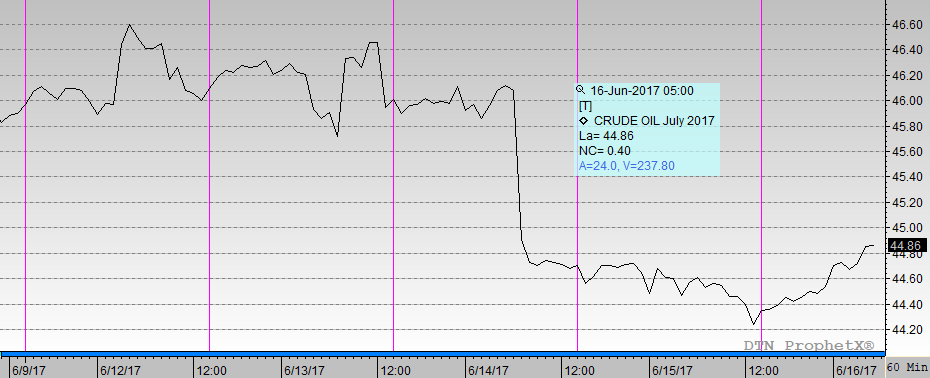

Oil prices declined significantly this week, for the third week in a row. This week, U.S. and global supply-demand fundamentals were weak, and prices dropped anew. WTI is below the $45/b level for the first time since mid-November, 2016. WTI opened at $44.25/b today, a significant drop of $0.44, or 0.98%, below yesterday’s opening price. Prices are trending up this morning, but it likely would take a serious threat to supply to cause prices to soar into the black. This week appears to be the fourth week in a row that crude prices will end in the red. Diesel prices have recovered and are slightly up for the week. Gasoline prices remain in the red.

WTI crude prices opened the week at $45.80/b. WTI opened this session at $44.25/b, a drop of $1.55, or 3.4%, from Monday’s opening. During the week, prices ranged from a low of $44.22/b on Thursday to a high of $46.71/b on Monday, a range of $2.49. Current prices are $44.83/b, up by $0.37 from yesterday’s closing price.

Diesel prices opened Monday at $1.4312/gallon. Diesel opened this morning at $1.4113/gallon, a decline of 1.99 cents, or 1.4% for the week. Prices ranged from a low of $1.4032/gallon on Thursday to a high of $1.4575/gallon on Wednesday, a price range of 5.43 cents. Current prices are $1.4327/gallon, up by 1.81 cents from yesterday’s closing price.

Gasoline prices opened Monday at $1.5017/gallon. Gasoline opened today at $1.440/gallon, a significant drop of 6.17 cents, or 4.1%, for the week. Prices ranged from a low of $1.4101/gallon on Thursday to a high of $1.5241/gallon on Monday, a large range of 11.40 cents. Prices are $1.4589/gallon currently, up by another 2.32 cents from yesterday’s close.

This week’s price slump is shaped like a milder version of last week’s price collapse, which resulted mainly by the release of the Energy Information Administration’s (EIA) weekly supply data. Last week’s news of across-the-board additions to stockpiles and weak apparent demand started a sell-off.

This week, the EIA reported a crude stock draw of 1.661 mmbbls, counterbalanced by another stock build of 2.096 mmbbls of gasoline and 0.328 mmbbls of diesel. The weekly supply data also noted a drop of 48 kbpd in apparent demand for gasoline, falling from 9,317 kbpd during the week ended June 2nd to 9,269 kbpd during the week ended June 9th. Last week’s supply data reported a drop of 505 kbpd. Apparent demand for gasoline for the first two weeks of June averaged 9,232 kbpd, more than 300 kbpd below May’s level.

The OPEC-NOPEC production cuts continue, but they were overshadowed by news this week of production gains by other producing countries. U.S. crude production rose by another 12 kbpd, bringing U.S. production to 9,330 kbpd. Libyan output rose to 730 kbpd in May, up from 552 kbpd in April. Nigerian output rose to 1,680 kbpd in May, up from 1,506 kbpd in April. Libya and Nigeria are not participating in the cuts, and both have announced ambitious production goals.

Low prices are expected to slow production gains, however, if they continue. If crude prices slide to around $40/b, it is believed that many development projects in shale plays and offshore may become uneconomical.

The Federal Open Market Committee met this week, and Fed Chair Janet Yellen announced, as expected, an interest rate hike. Economists anticipate one more increase this year, possibly in December. The U.S. Dollar had opened lower for four trading sessions in a row, but it has largely regained its position this morning.

This article is part of Crude

Tagged: Weekly Review

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.