Week in Review – September 4, 2020

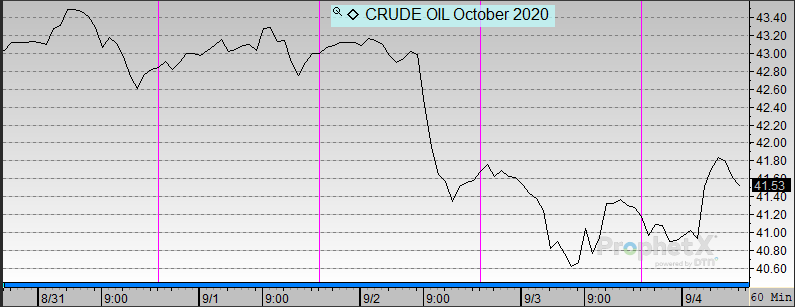

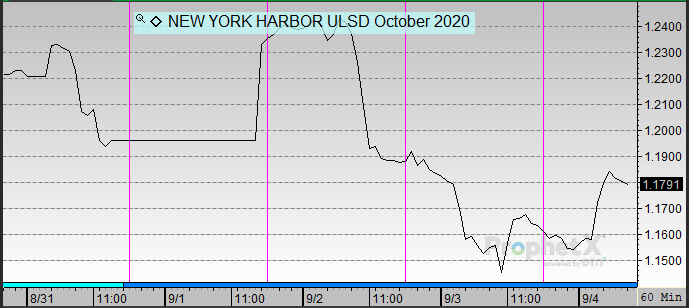

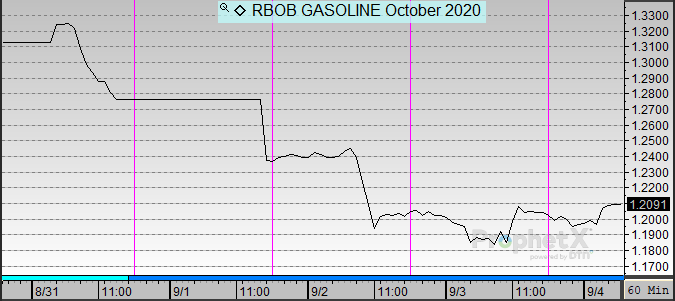

WTI crude finished the week with losses as sentiment weakens among traders. The effects of Hurricane Laura spilled over into the beginning of this week to buoy prices with decreased production from the Gulf. Rigs were slow to bring back production from the storm, and Gulf Coast refineries continued operating at lower utilization rates after the storm had passed.

A weaker dollar and positive manufacturing news from the US and China helped to maintain prices through the middle of the week. While inventory data was bullish on Wednesday, a report from the EIA regarding lower gasoline demand sent prices lower to close the week. On Friday, even with bullish jobs data supporting equity markets, fuel prices are falling heading into the weekend.

Prices in Review

WTI Crude opened the week at $42.91. It was flat to open the week then fell mid-week as demand worries influenced the market. Crude opened Friday at $42.25, a loss of 66 cents (-1.5%).

Diesel opened the week at $1.2230. It followed a choppy week of trading to close the week lower. Diesel opened Friday at $1.1644, a loss of 5.9 cents (-4.8%).

Gasoline opened the week at $1.3241. It followed a general downward track throughout the week to close the week down. Gasoline opened Friday at $1.2049, a loss of 11.9 cents (-9.0%).

This article is part of Daily Market News & Insights

Tagged: Economy, Tags: Refinery Utilization

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.