Week in Review – September 2, 2022

Although the week began with a roar of bullish energy, later developments suggested a different market direction. Last week, the news was strictly focused on strong US demand data, tight inventories globally, and supply limitations for OPEC countries. This week, however, brought more focus back to China’s economic challenges… especially their zero-COVID strategy. Lockdowns have once again hindered factory output and consumer demand, putting their growth in jeopardy.

The Iran Nuclear Deal is also back in play, with both countries pushing towards a deal that would allow Iran to sell 1-2 MMbpd more oil to the global market (plus immediately offload the 150-200 million barrels of floating storage they have today). Both sides have made positive comments, while noting obstacles that so far have not been solved. If signed, some analysts have suggested that oil prices could fall as low as $65/bbl by the end of next year, once Iran is back to full-time production.

This week the EIA showed yet another draw from crude and gasoline inventories, though diesel stocks ended the week with tiny increases. Diesel demand hit a record high for PADD 3 last week, and exports have been very strong. That’s made it hard for markets to build inventories ahead of the winter, a period when demand increases in the north.

In the Midwest, the Whiting refinery announced that maintenance would be completed by the end of this week, providing assurance that local supply challenges will not spiral out of control. The refinery provides a significant portion of fuel to the Wisconsin, Illinois, Indiana, and Ohio markets.

Prices in Review

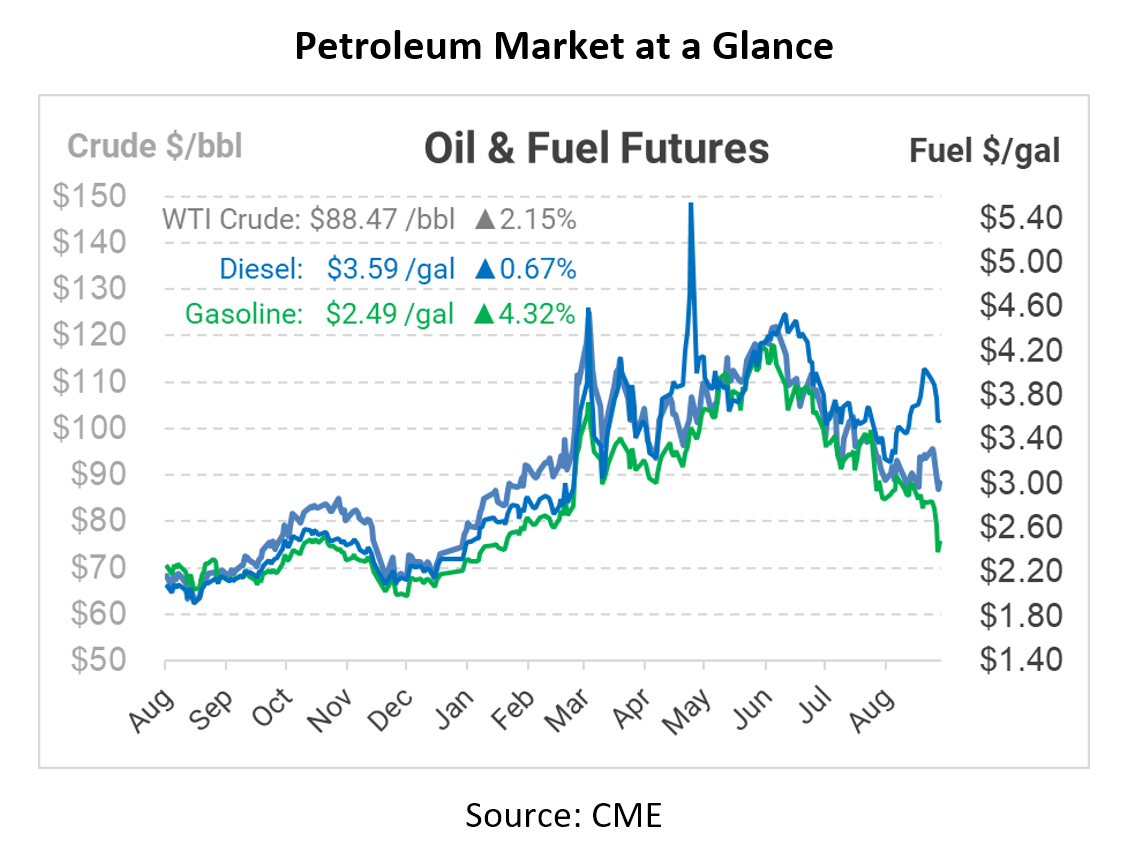

Crude oil prices opened the week at $92.96, and by the end of Monday prices had risen as high as $97/bbl. But prices turned lower after that, with prices crashing more than $5/bbl on Tuesday to just $91.64. Prices continued falling, hitting a low point around $86 before rebounding this morning. Today prices opened at $86.56, a loss of $6.40 (-6.9%).

Diesel prices plummeted this week. Opening Monday at $3.9975, prices fell 10 cents each day this week, and dropped 15 cents on Thursday. This morning, prices are slightly higher, with a 3 cent increase from yesterday’s closing price. The market opened at $3.5575 this morning, a loss of 44 cents (-11.0%).

Gasoline saw similar losses, bringing prices to levels not seen in months. Gasoline opened at $2.8398 on Monday, shedding 5 cents during the trading session. Like diesel, prices fell 10 cents on Tuesday and Wednesday, with a hefty 20 cent drop on Thursday. This morning, gasoline opened at $2.3853, a loss of 45 cents (-16.0%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.