Week in Review – Oil Rally Continues

Let’s start off with the most important fundamental market news this week – Groundhog Day! Punxsutawney Phil saw his shadow, heralding six more weeks of winter weather. Of course, the creature only has a 39% accuracy rate – worse than flipping a coin! – so perhaps we ought to presume the opposite of his prediction will come true. Spring, here we come!

Saudi Arabia’s voluntary supply cuts went into effect this week, and oil markets have been responding with a rush of enthusiasm. Prices have closed higher every day this week, notching roughly $1/bbl gains each day. The entire OPEC+ group is also contributing to bullish sentiment; this week, they agreed to maintain existing cuts through the end of March before considering tapering prices.

Midweek, the EIA offered its insights on market trends, which followed expectations. Crude inventories fell moderately, while diesel stocks stayed flat. Gasoline saw a bigger than expected build but remains below the five-year average. Refiners boosted their throughput, but utilization remains in the low-80s range, consistent with past weeks.

On Friday, prices continued moving higher, buoyed by the week’s trends. The three major factors – OPEC, vaccines, and stimulus legislation – all showed positive trends this week. OPEC maintained their production cut commitment, keeping supplies under control. Vaccines are being rolled out rapidly, with President Biden commenting that the US is on target to hit 100 million vaccines delivered in his first 100 days. Finally, Congress seems to be warming up to stimulus legislation – whether that be the full $1.9 trillion package or a moderated version. All signs point to recovery and bullish trends, which is why prices have gained nearly $5/bbl this week.

Prices in Review

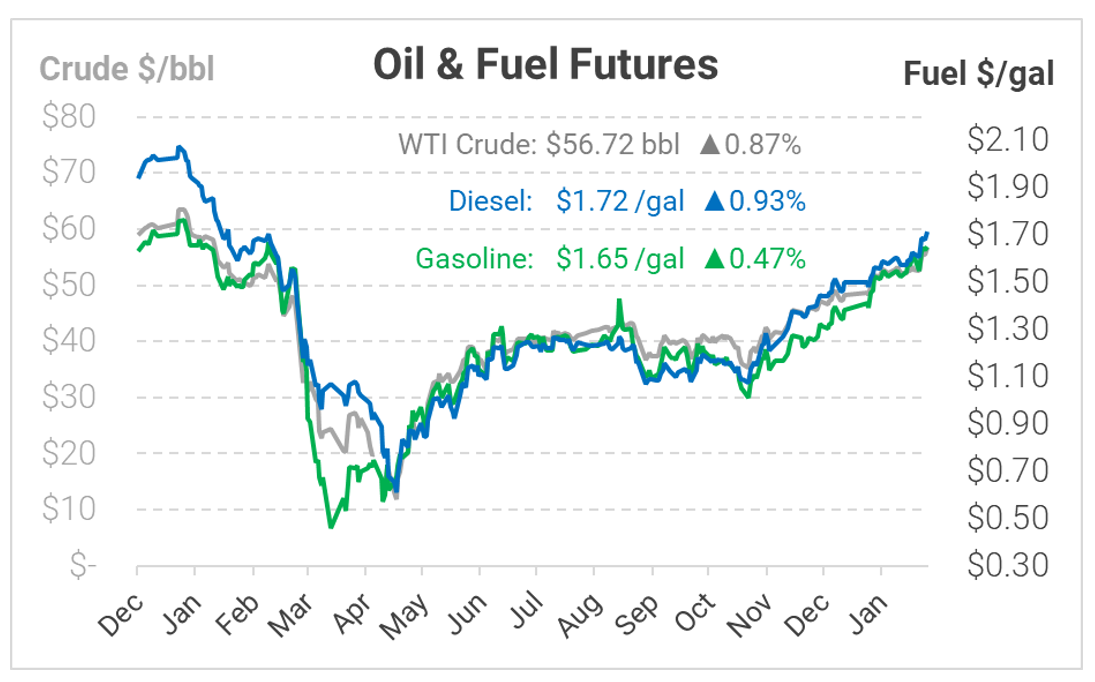

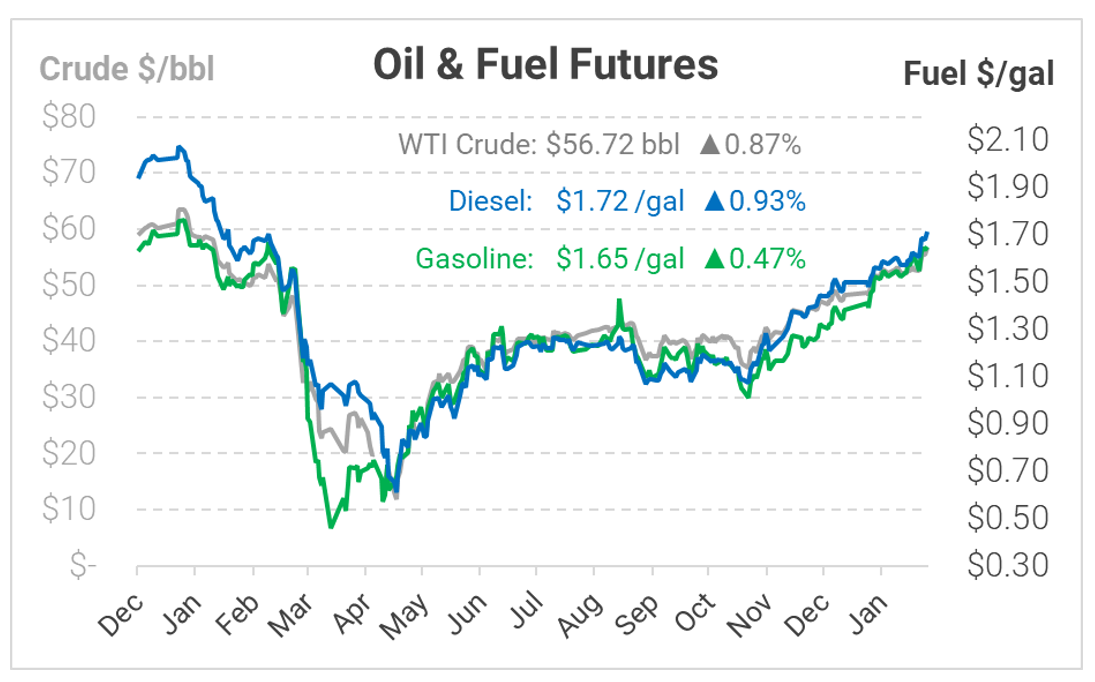

Crude oil opened the week at $51.99 – a low point after weeks of trading within the $52-53 range. But that low point wouldn’t hold long, and prices quickly began rising. WTI crude closed $1.50 higher that day, and continued rising throughout the week top open Friday at $56.46 – a gain of $4.47/bbl (+8.6%).

Huge crude gains were mirrored in the fuel markets, though fuel gains were muted in comparison. Diesel opened the week at $1.5949, climbing more than ten cents over the week’s course to open Friday at $1.7079. That represents a gain of 11.3 cents, or 7.1%.

Gasoline began the week at $1.5527, shedding a couple cents from the previous Friday’s closing price. Still, prices quickly caught up with the rest of the market. By Friday, gasoline opened at $1.6535, a ten cent, or 6.5%, gain.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.