Week in Review – October 4, 2019

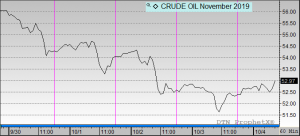

The Crude Market was down for the week. The week opened with news of continued diplomacy in the Middle East and a strong dollar, both of which put downward pressure on the markets. Poor manufacturing reports and general macroeconomic pessimism continued to drive markets lower through the week. The downward trend in equities spilled over to create a looming fear of slowing oil demand.

A bearish inventory report by the EIA mid-week helped to extend the streak of crude price losses to eight days to close the week. The reported 3.1 MMbbls build was larger than expected and counter to the API report of a 5.9 MMbbls draw. The build showed that the market was well supplied even as Saudi production was less than optimal. Now that Saudi production has been restored to pre-attack levels, the markets will likely feel downward pressure as they readjust supply capability.

Prices in Review

WTI Crude opened the week at $56.54. It followed a steady downward trend based upon poor economic news and bearish inventory reports. Crude opened Friday at $52.29, a loss of $4.25 (-7.5%).

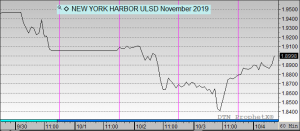

Diesel opened the week at $1.9504. It followed crude through the week, but closed the week showing some bullishness. Diesel opened Friday at $1.8761, a loss of 7.4 cents (-3.8%).

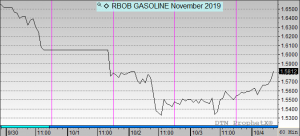

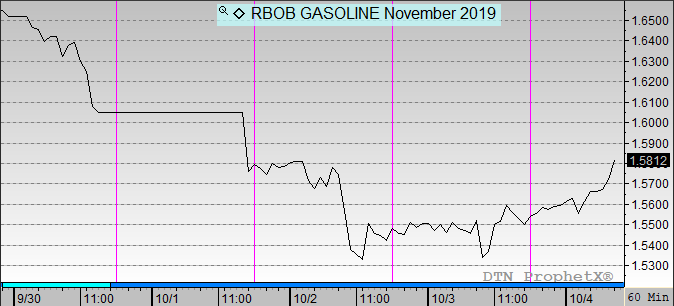

Gasoline opened the week at $1.6561. It generally followed crude and closed the week with an uptick. Gasoline opened Friday at $1.5477, a loss of 10.8 cents (-6.5%).

This article is part of Crude

Tagged: bearish inventory, Crude Market, demand, eia, macroeconomic pessimism, Middle East, oil prices, Saudi

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.