Week in Review – November 18, 2022

Oil prices are down into the $70s for the first time since September as the oil market once again grapples with falling demand and a weak economic outlook. Although we’re drawing closer to the EU embargo on Russian oil, markets are also contending with declining demand. So far, price drops into the $70s have been short-lived, so we’ll see how long today’s decline lasts.

Diesel price volatility is beginning to calm some, with the spread between NY Harbor and Gulf Coast diesel prices now “only” 60 cents. Although down from $1.40 a few weeks ago, that’s still 6x more than the typical upper limit before 2022. While the spread remains open, diesel producers are incentivized to move product directly from Gulf Coast refiners to New York Harbor, circumventing the Southeast and causing supply issues.

This week, a Russian missile falling in Poland created concerns that NATO could be brought into open conflict with Russia, but heads cooled once the official statement reported that the missile was fired by Ukraine and strayed across the border by accident. Weak economic data from China has been a focal point, with the country remaining committed to its zero-COVID policy even as its somewhat relaxed some health policies.

In market fundamentals, the EIA reported a 5 million barrel draw for crude oil inventories and a 1 million barrel build for diesel stocks, helping to bring supplies a bit closer to the average. Of course, inventories remain below historical levels, but the trend is finally showing moderate improvement in direction. Refinery utilization has been rising for the past month, with plants running at 92.9% utilization this past week. Higher activity means more fuel availability, which bodes well for winter supply.

Prices in Review

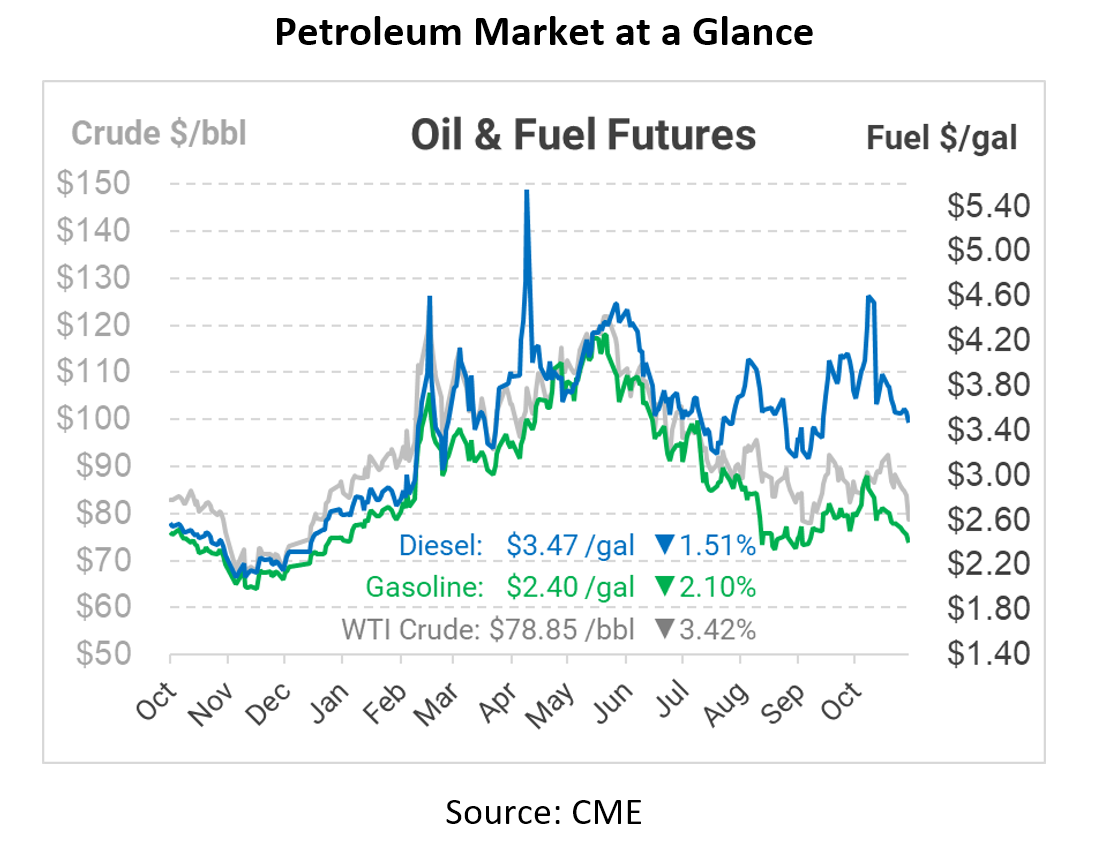

Crude oil fell steadily through the week, excluding a brief uptick Tuesday evening following the news in Poland. Opening the week at $89.02, prices fell slowly before tumbling to $81 on Thursday. On Friday, the market opened at $82.09, a loss of $6.93 (7.8%) before dropping into the $70s.

Diesel prices were a bit more volatile this week, jumping up and down early in the week before turning lower after the EIA’s report. Diesel opened the week at $3.5846, but rose above $3.60 early on. That wouldn’t last, though, and prices tumbled Thursday down towards $3.50. On Friday, diesel opened at $3.5199, down 6.5 cents (-1.8%). Currently, the market is trading even lower, with prices around $3.45.

Gasoline saw persistent losses through the week, with a sharp drop on Monday and continued losses after that. Opening at $2.6193, prices fell each day this week. On Friday, gasoline opened at $2.4660, down 15.3 cents (-5.9%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.