Week in Review – November 10, 2022

This week brought a downward slant, with crude oil shedding $5/bbl and fuel prices dropping 20-25 cents per gallon. Although diesel fuel supplies continue dominating headlines – and indeed, spot prices remain elevated – the futures market is showing some cooling this week.

Of course, the midterms this week have been a focal point. With Republicans favored to win the House and the Senate still close, plenty is up in the air. Between GOP control of the House and Biden’s veto power, expect political gridlock for the next two years, with major policy accomplishments unlikely. Markets tend to favor a divided government, so the results could mean higher prices in the days ahead. Still, given how few short-term options the government has for impacting fuel markets, the elections aren’t likely to have a significant impact on fuel supplies over the next few months.

Inflation reportedly fell to 7.7% this week, below the higher levels seen over the past few months. Core CPI, which measures inflation but excludes volatile categories like food and energy, came in at 6.3%, below expectation. Although still high, it seems that higher interest rates are slowing domestic demand, bringing inflation lower. The key now is to watch economic data, since interest rates can only reduce demand by lowering economic growth. If markets slow down too much, we could see a recession in 2023.

The EIA published its weekly market data as well as its monthly Short-Term Energy Outlook (STEO) this week. The STEO reported that diesel inventories ended October with just 104 million barrels, the lowest since 1951. The weekly data showed small draws from diesel and gasoline inventories, though markets considered it good news that inventories didn’t see an even larger draw.

Prices in Review

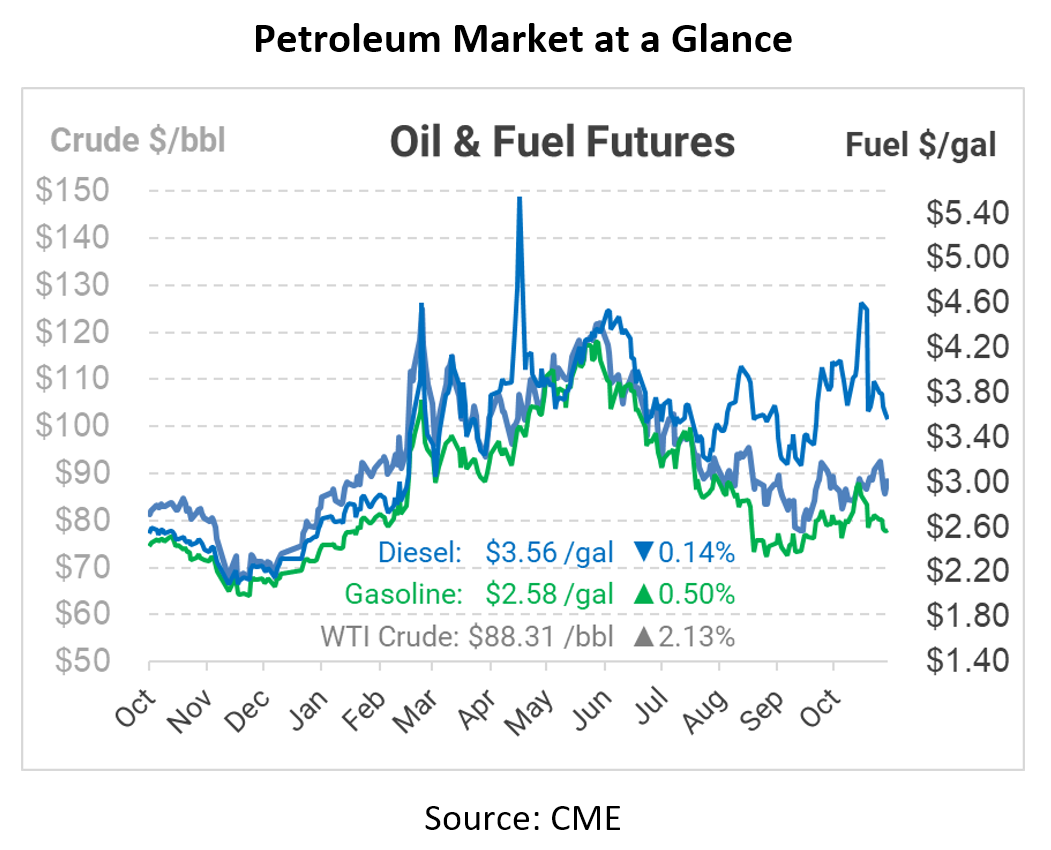

Crude oil opened the week at $91.00, entering the week strongly after last week’s rally. But high prices didn’t stick for long. A noticeable build reported by the EIA sent prices tumbling on Wednesday to a low of $85/bbl before ticking higher. On Friday, crude opened at $86.27, a loss of $4.73 (-5.2%) for the week.

Diesel prices didn’t receive the same support as crude later in the week, with prices falling continuously through the week. Diesel began the week at $3.90, but by Friday prices fell to just $3.5729, down 32.7 cents (-8.4%).

Gasoline also fell for most of the week, though trading on Friday has brought prices a bit higher. Gasoline opened the week at 2.7356, dropping on Monday, Tuesday, and Wednesday before stabilizing. On Friday, the consumer product opened at 2.5638, down 17.2 cents (-6.3%) this week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.