Week in Review – May 29, 2020

WTI crude started the short week on Tuesday, trading at levels not seen since early March. Comments from the IEA’s executive director were bullish on demand returning to pre-crisis levels and higher. Souring the rally as the week progressed was OPEC+ news from Russia regarding tapering off production cuts in July. While the original OPEC+ proposal had been to taper the current 9.7 MMbpd cuts down to 7.7 MMbpd in July, markets are hoping for a continuation of current cuts when OPEC+ Meets in June. Discussion between Russia and Saudi Arabia is ongoing, but Russia has made its opinion known. Russia believes the cuts have done their job, and bringing production back online is the best course of action.

Prices in Review

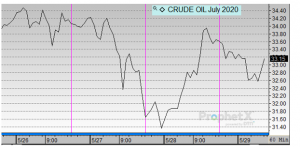

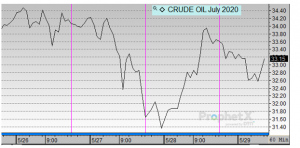

WTI Crude opened the week at $33.30. It bottomed out mid-week but recovered as the week closed. Crude opened Friday at $33.68, a gain of 38 cents (1.1%).

Diesel opened the week at $0.9891. It followed a downward trend throughout the week to close lower. Diesel opened Friday at $0.9313, a loss of 5.8 cents (-5.8%).

Gasoline opened the week at $1.0312. It fell to mid-week and recovered some of the week’s losses to close the week lower. Gasoline opened Friday at $0.9910, a loss of 4 cents (-3.9%).

This article is part of Daily Market News & Insights

Tagged: China, coronavirus, Hong Kong, South Korea, trade deal

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.