Week in Review – May 27, 2022

Headlines this week included ongoing supply chain tightness, some methods the White House thinks will lower fuel costs, understanding the SPR, and a look ahead to Memorial Day. Summer is nearly here, which means travel is going to pick back up. With fuel supplies stretched thin and gasoline inventories sinking, it’s looking like this summer could see significantly higher fuel prices. New data is showing that more people are driving in the United States lately, and this will certainly start to pick up as planned summer vacations unfold. To add to the supply tightness, today a weaker U.S. dollar is making crude cheaper to buy, shaking up the supply chain even more.

With summer demand approaching and prices still elevated, politicians are scrambling to find new levers to pull to alleviate fuel costs. Over the past week, two considerations have come to light that may offer some small relief. According to a CNN report, President Biden is considering a release from the Northeast Home Heating Oil Reserve, which holds around 42 million gallons of diesel fuel (or one day of regional supply). Like other reserve releases, the move will not fundamentally improve the market, but it may help resolve some spot outages in the Northeast. Created in 2000 to offset severe winter storms, the Northeast Reserve has only been tapped once before: in 2012 after Superstorm Sandy.

For gasoline, the administration is considering waiving an environmental rule that prevents summer smog, allowing high-RVP fuel to be used through the summer. Already, the White House has waived the rule for E15 blends, to allow cheaper ethanol to be used all year round. This latest waiver will apply to all gasoline blends. RVP requirements have been waived often in the past for regions with especially stringent requirements in response to hurricanes and other supply or demand disruptions, with the latest broad waiver coming in May 2020 when COVID-19 caused winter-blend gasoline to stack up in inventories. Winter-blend gasoline is a bit cheaper to refine, so this action could have a 3-10 cent impact on fuel prices.

The Strategic Petroleum Reserve (SPR) has come up as an important subject since the beginning of the Russia-Ukraine invasion. Founded in 1982 with just over 250 million barrels, the reserve has been used throughout modern history to offset severe volatility and keep prices lower. Storage was maxed out in the 2008-2010 period; since then, the reserve has declined slowly. The past 3 months have seen the SPR fall faster than ever, so it’s worth digging deeper to understand where that oil came from, where it’s located, and how much is left. Over the past 40 years, the SPR rose from a meager 250 million barrels to nearly 750 million barrels. Although held for strategic supply reasons, the SPR is also somewhat of an economic boon: across time, the average cost per barrel has been $29.70, and the average sale price has been $61.64. At current oil prices, the strategic reserve is worth nearly $61 billion – more than double the total cost of the oil in reserve. Of course, the storage and carrying costs add additional costs over time, but at a high level, the investment is valuable. Click Here to read more on the SPR.

Lastly, for the past two weeks, oil prices have been rising steadily. When some relief does appear in the form of lower prices, it seemingly does not last long enough. Today crude prices are hovering around the $111.17 mark, much higher than two weeks ago. The national price of gasoline, according to AAA, is sitting at around $4.600. This number is up almost 42 cents from March when the national average record was broken with a price of $4.17. Despite historic prices, due to people wanting to get back out, expect to see busy interstates and tourist cities this Memorial Day. With more and more people leaving their homes for some sort of short vacation, demand will be increased which means supply must act quickly. According to new data, across all methods of transportation (cars, trucks, tankers, etc.), there will be an 8% increase in travel this weekend compared to its 2021 counterpart.

Prices in Review

WTI Crude opened the week at $110.56. Prices dropped briefly Tuesday and Wednesday before climbing back up. Crude opened Friday at $114.20, an increase of $3.64 the beginning of the week.

Diesel opened the week at $3.7480. Diesel increase steadily throughout the week before opening Friday at $3.9967, an increase of $0.2487 from the start of the week.

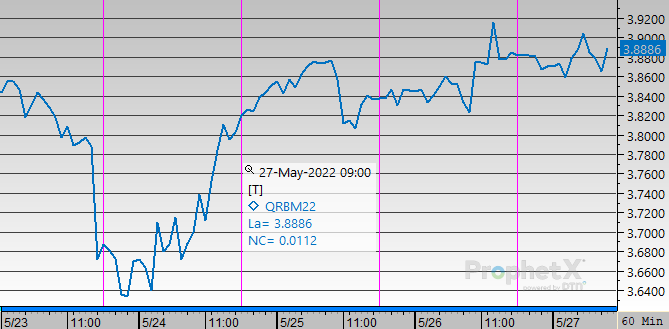

Gasoline opened the week at $3.8420. Similar to crude and diesel, after dropping off on Monday prices gained throughout the rest of the week. Gasoline opened on Friday at $3.8716, an increase of $0.0296 throughout the week.

This article is part of Week in Review

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.