Week in Review – May 15, 2020

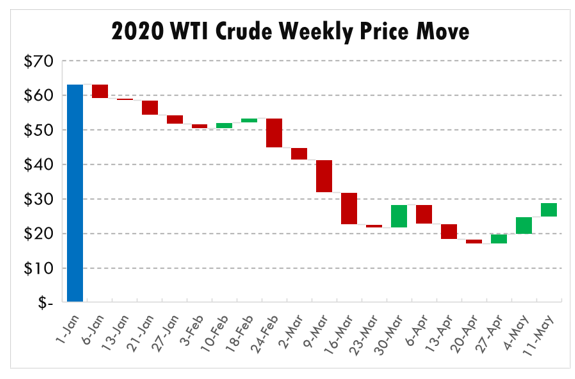

The crude market is on track to post its third weekly gain, bringing crude prices to their highest level in over a month. With rig counts falling to all-time lows, markets anticipate declining US oil production, which combined with OPEC+ cuts should help bring supply and demand back into balance. Many analysts believe oil markets are beginning a long, painful return to normal levels. A critical threshold to watch will be when prices break above $30, a level most shale producers need to operate existing wells profitably.

Saudi Arabia and other OPEC countries are instituting deeper supply cuts beyond their OPEC+ commitments. Saudi Arabia committed to making an additional cut of 1 MMbpd. UAE and Kuwait are also making cuts to help support the Saudi Kingdom in its efforts to balance the market.

To close out the week, the IEA forecast an upward revision to demand projections for later in the year. The bullish forecast lifted prices and helped the week finish on a high note.

Prices in Review

WTI Crude opened the week at $24.49. It trended steadily upward throughout the week. Crude opened Friday at $27.64, a gain of $3.15 (12.9%).

Diesel opened the week at $0.9016. Another week of sizable inventory builds pushed prices lower as the week continued, but by Thursday the market succumbed to the overall rising tide in oil markets. Diesel opened Friday at $0.9030, a fractional gain, and is experiencing some gains in early trading this morning.

Gasoline opened the week at $0.9600. Like diesel, It began the week on a downward trajectory until bullish demand news helped it to recover losses to close out the week. Gasoline opened Friday at $0.9275, a loss of 3.3 cents (3.4%).

This article is part of Week in Review

Tagged: crude, Daily Market News & Insights, diesel, gasoline, opec, Prices in Review, Saudi Arabia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.