Week in Review –May 1, 2020

The crude market was up for the week, marking one of the first weekly gains in quite some time. This week began with news of crude storage capacity tightening around the world. Reportedly, global crude storage stood at 85% of total capacity to begin the week, and South Korea had used up all its available storage.

By mid-week, bullish inventory news lifted markets. A smaller-than-expected build in crude stocks and a surprise draw in gasoline helped to move the markets higher. Increased demand for gasoline was attributed to states coming out of quarantine, with businesses beginning to reopen and personal travel starting to return to normal levels.

With the world beginning to reopen, COVID-19 cases slowly falling, and economies struggling to get by, markets are still experiencing extremely high volatility. While no one can definitively predict a bottom in the market, many have speculated that markets are now on the mend. Whether this is true or not is anyone’s guess – but for the sake of global health and economic well-being, many are hoping the worst is behind us.

Prices in Review

WTI Crude opened the week at $16.84. It began lower to start the week but climbed steadily through the week to close higher. Crude opened Friday at $19.04, a gain of $2.20 (13.1%).

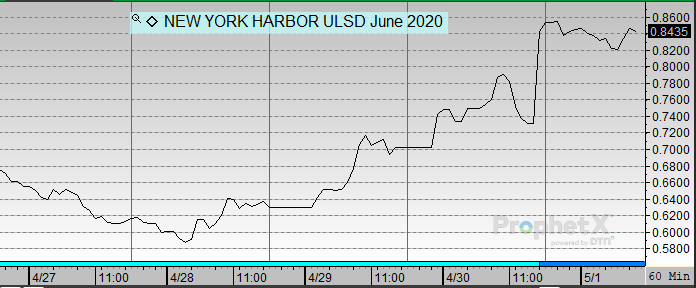

Diesel opened the week at $0.6620. It followed a similar track as crude through the week. Diesel opened Friday at $0.8389, a gain of 17.7 cents (26.7%).

Gasoline opened the week at $0.6451. It generally followed crude throughout the week. Gasoline opened Friday at $0.7801, a gain of 13.5 cents (20.9%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.