Week in Review – March 4, 2022

This week major headlines included Saudi Arabia possibly being the answer to higher oil prices amid market tensions, the State of the Union address and what exactly what said about the energy industry, and oil prices reaching their highest numbers since 2008. Some countries have thought of Saudi Arabia as an immediate solution to the supply chain’s problems, but just how significant of a player could they be? Currently, Saudi Arabia can raise their production levels by 2 million barrels per day – but their willingness to add that much seems to be in question. When confronted about possibly increasing output, the Saudi government insisted that OPEC+ continue to stick to their planned output schedule. Analysts suggest that Saudi Arabia is doing everything they can not to involve themselves in potential geopolitical tensions, so no move by Saudi Arabia will be expected.

During the state of the union, major topics included the newly appointed Supreme Court Justice, inflation, and energy prices. The President announced that the U.S., together with the International Energy Agency, would release another 60 million barrels of crude oil from various global reserves. This total number includes 30 million from the United States. Per the International Energy Agency, 60 million barrels is around 4% of the total 1.5 billion barrels of stockpile that the agency has reserved for emergencies. The 60-million-barrel release only equates to around 6 days of Russian oil production or 12 days of Russian exports. While the impact may not be as significant as people were expecting, Biden remains firmly situated in his stance to isolate Russia and their economy from the rest of the world, and until then the United States and allies will find their own ways to combat supply chain problems as it relates to energy. Time will only tell to see how effective this new release will really be.

Lastly, we talked about the rising price of oil reaching highs not seen since 2008. Diesel was up 70 cents over the past week with a staggering 35 cent increase in price yesterday alone. Notably, Wednesday was the largest single day increase in diesel history, with the previous record of 29 cents ominously set in June 2008. Since Russia’s invasion last week, gasoline prices are also up near 50 cents. It’s worth noting that sanctions are not directly targeting Russia’s oil. Despite this fact, traders are avoiding Russian products altogether, slowing down their exports by as much as 70%. Goldman Sachs recently noted that supply cannot keep up with the current demand for oil, leaving demand destruction (via high prices) as the only mechanism for market balancing. If this is correct, it should be expected to continue seeing price volatility in the coming weeks.

Prices in Review

WTI Crude opened the week at $94.99. Prices Rose throughout the week reaching highs not seen since 2008. Crude opened Friday at $107.96, an increase of $12.97 from Monday.

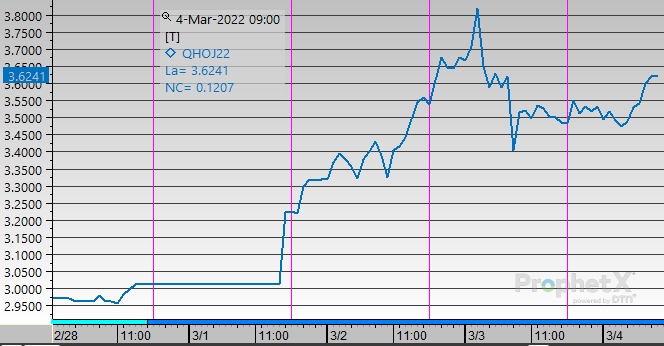

Diesel opened the week at $2.9710. Diesel was similar to crude, increasing throughout the week before reaching highs on Thursday. Today diesel opened at $3.5077, an increase of $0.5367 from Monday.

Gasoline opened the week at $2.7317. Prices started off low on Monday before spiking and reaching weekly highs on Thursday. Today gasoline opened at $3.3039, an increase of $0.5722 from Monday’s opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.