Week in Review – March 18, 2022

This week headlines included Russia-Ukraine talks driving prices down at the beginning of the week, oil falling below $100 and what that means for gas, where Russian sanctions are hurting most, and the Fed approving an interest rate hike. Since the invasion, Russia has already agreed to allow safe zones for Ukrainian citizens; however, the death toll continues to rise as Russian missiles are hitting populated areas. It is estimated that the invasion of Ukraine has caused over $119B in damages and has claimed around 15,000 lives. The talks went “well” according to the Ukrainian president, but once again a cease-fire and reduction of Russian troops seems unlikely after the meeting.

Tuesday was the first time since March 1 that oil has dropped below the $100/bbl mark. Now that consumers see numbers in the $90-$97 range, they want to know if they will immediately feel relief for their wallets when filling up vehicles. The answer is: while it may not be as immediate as you want, prices will start to change at the pump. Analysts suggest that if crude prices hold around the $90’s that we will start to see around a 20-cent decrease per gallon. Prices would still be elevated compared to pre-invasion levels, but they would not be hovering around the record high numbers that emerged with the Russian invasion of Ukraine.

A lot of what is happening at the pump is also directly related to sanctions from NATO countries against Russia. The nationalization of western assets (a threat by Putin) could be disastrous for oil markets over the long-term. Western oil majors have been instrumental in bringing Russian oil to the heights it has reached, but majors would be very hesitant to re-engage if they believe their financial interests can be stolen by the government at any time. Without assistance, Russia’s oil businesses could flounder, struggling to keep pace with their customers’ demand. We could even see a scenario comparable to Venezuela, in which a major oil producer falls to a net importer due to sanctions and under-investment. A dwindling Russia would mean less oil hitting global markets, keeping prices structurally higher.

Lastly, this week Federal Reserve agreed to the first interest rate increase in more than three years. With inflation skyrocketing to record levels, the Fed hopes to curb rising prices through interest rates. The Federal Open Market Committee released news on Wednesday that they would be raising rates by 0.25%, or 25 basis points. The Fed will not stop with this increase, however, noting plans to hike rates six more times this year until rates hit 1.9%. To read this article in depth, please click here.

Prices in Review

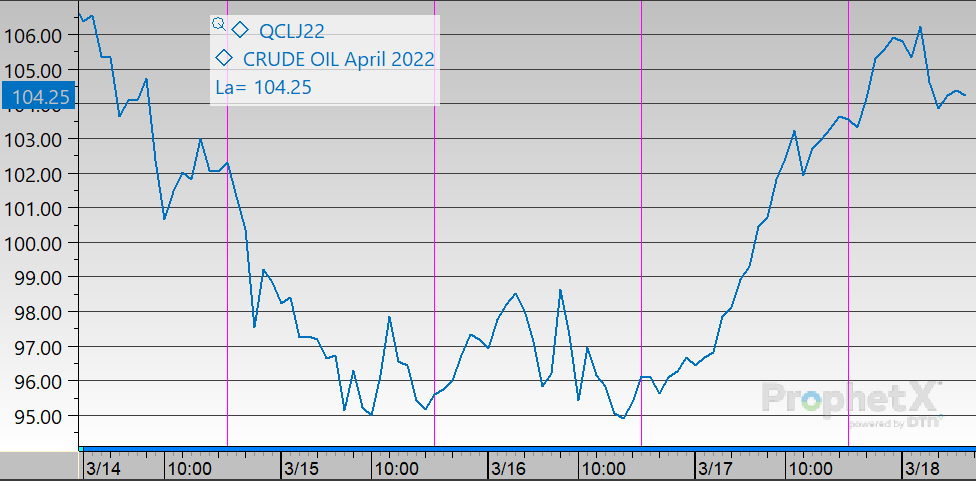

WTI Crude opened the week at $109.42. Prices dropped throughout the week before climbing back up Thursday and Friday. Crude opened Friday at $103.62, a decrease of $5.80 from Monday.

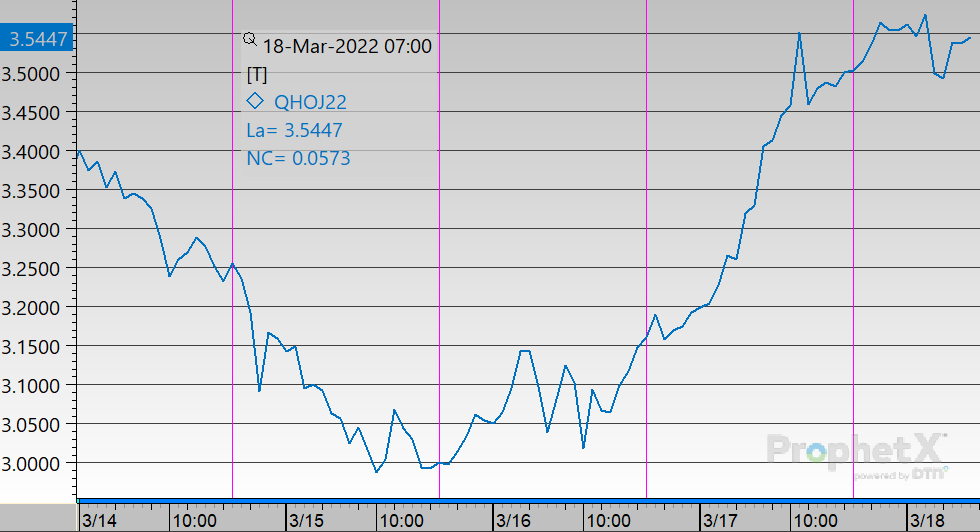

Diesel opened the week at $3.4176. Diesel was similar to crude, decreasing throughout the week before gaining on Thursday and Friday. Today diesel opened at $3.4878, an increase of $0.0702 from Monday.

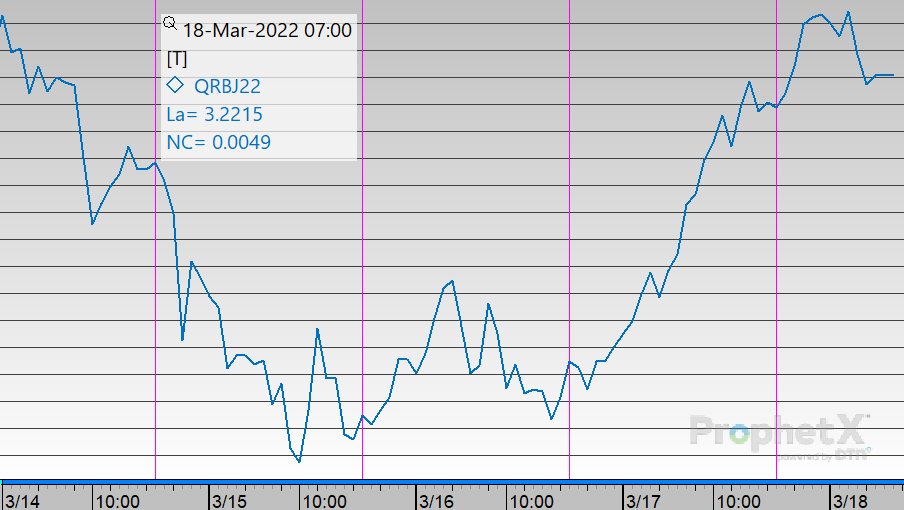

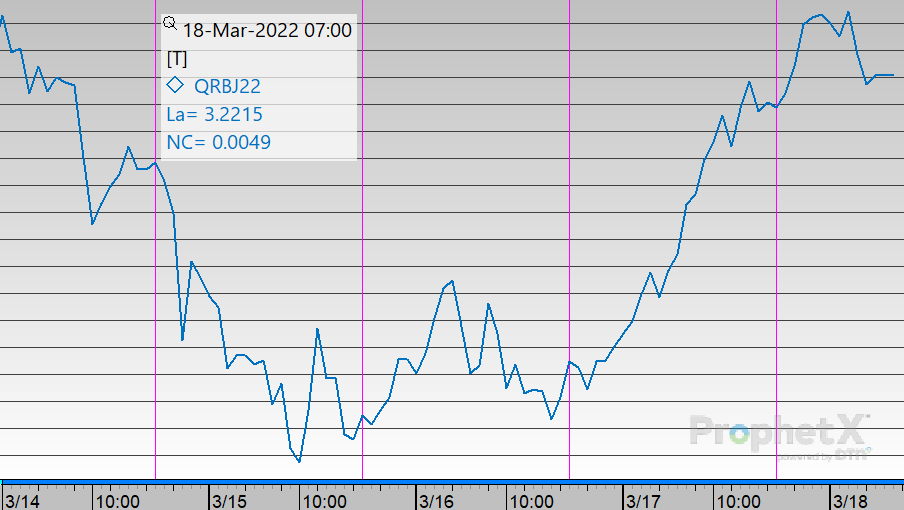

Gasoline opened the week at $3.3120. Prices started off decreasing before making slight gains later in the week. Gasoline opened today at $3.2220, an increase of $0.09 from Monday’s opening price.

This article is part of Daily Market News & Insights

Tagged: 2022, crude, diesel, Federal Reserve, gasoline, NATO countries, prices, Week in Review – March 18

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.