Week in Review – March 12, 2021

Oil prices surged to multi-year highs on Monday morning, with an attack on Saudi oil infrastructure adding to market risk estimates. When those attacks did not yield any damage, prices fell back to pre-attack levels, continuing to fall even lower as the week continued.

Fuel market turmoil has plagued many parts of the US. Refinery utilization remains at historically low levels, which has put pressure on inventories and supply chains. Many Texas terminals have intermittently run out of fuel, putting a strain on fuel supplies and carrier capacity as fuel trucks chase available product. The outage has spread to different Southeastern markets, causing prices to rise in many regions. The EIA’s report on Wednesday showed steep refined product draws, while crude oil saw a hefty build.

On Thursday, President Biden signed the $1.9 trillion stimulus bill, which provides an injection of funds for consumers, small businesses, schools, and healthcare providers. Strong economic growth may also trigger inflation, which could also contribute to higher fuel prices. On the flip side, inflation typically brings higher interest rates, which in turn support the US dollar and cause prices to fall. There’s a never-ending push/pull from different economic factors that will make predicting prices difficult. From a fundamentals standpoint, there’s plenty of oil demand and limited supply, which suggests prices at least staying at current levels, or even continuing higher.

Prices in Review

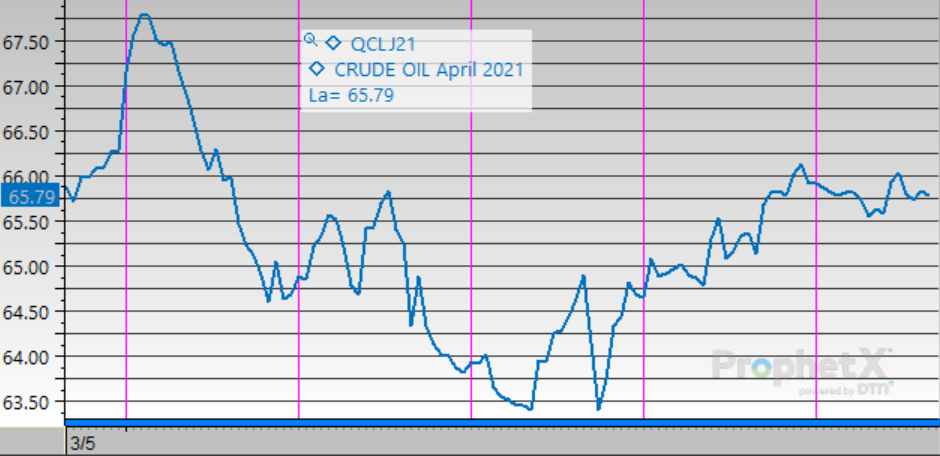

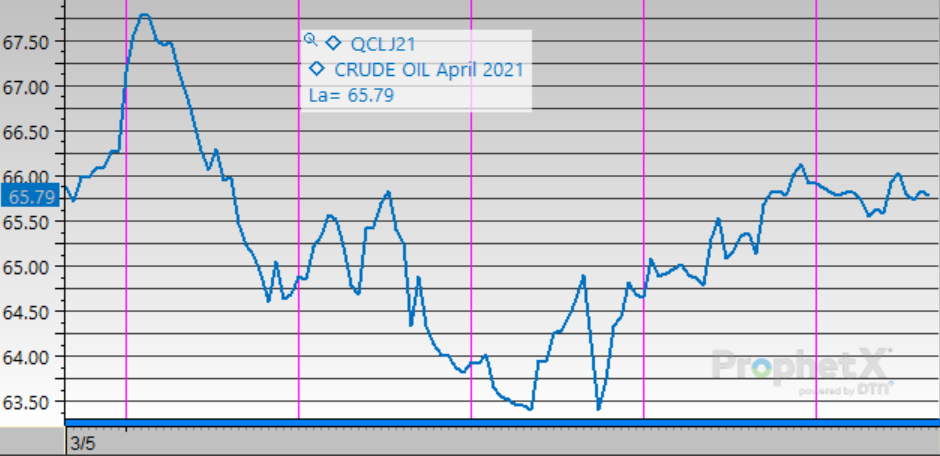

Crude oil began the week with an early trading boost, propelling the opening price on Monday to $66.68. The Saudi attack-driven rally faded quickly, and prices closed Monday just above $65/bbl. Weakened sentiments saw prices continue falling, bottoming on Wednesday before the EIA revealed continued refined products chaos driven by refinery issues in Texas. The stimulus bill helped give prices a lift on Thursday, leading prices to open Friday at $65.96, down 72 cents (-1.1%) from Monday’s opening price.

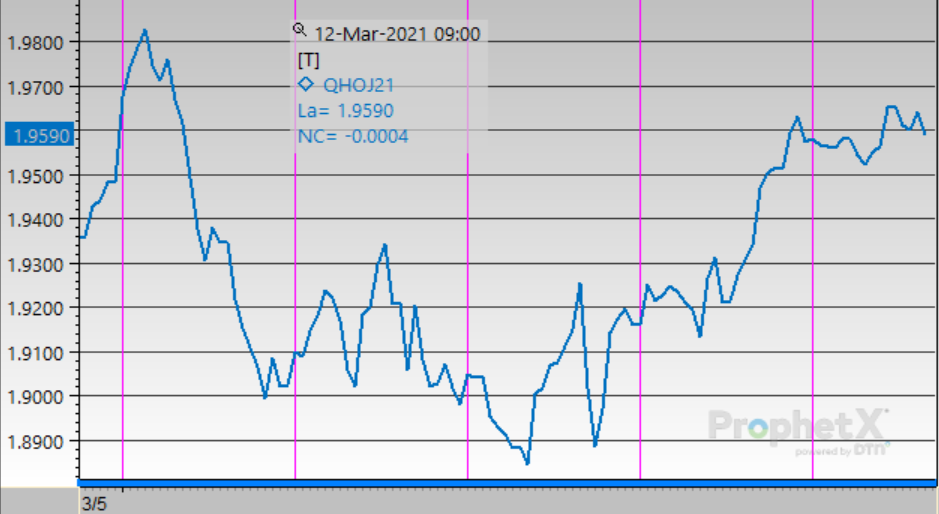

Diesel prices also rocketed higher on Monday morning, opening at $1.9540 before closing Monday with five-cent losses. Prices remained week until Thursday, with the passed stimulus bill promising economic growth and climbing diesel demand. On Friday, diesel prices opened at $1.9594, half a cent above Monday’s closing price.

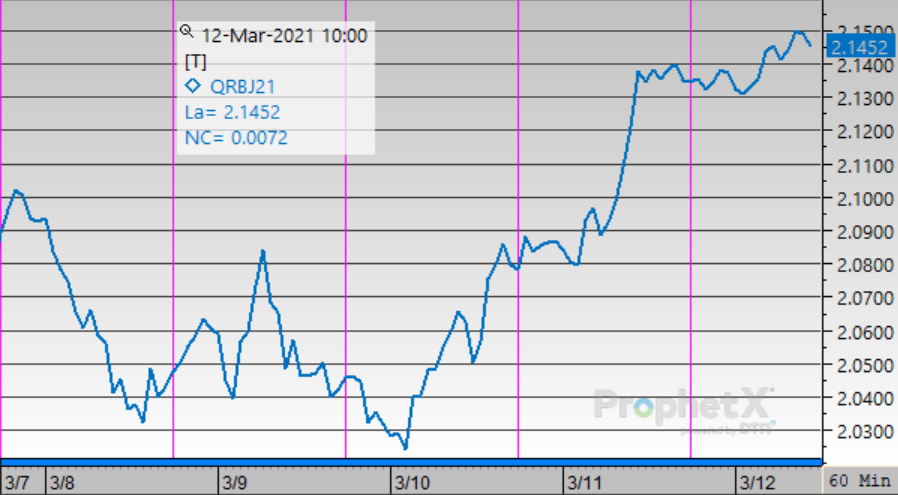

Gasoline ended the week solidly above its opening price for the week. Gasoline opened at $2.0826, a hefty gain from the previous Friday’s opening price, and traded sideways/lower for much of the week. The injection of $1,400 checks for American consumers promised to unleash a wave of summer demand, which pushed prices steeply higher on Thursday. Friday opened with gasoline at $2.1356, up 5.3 cents (+2.6%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.