Week in Review – March 10, 2023

Oil markets are expecting a busier than usual maintenance season over the next few months, meaning less supply in the short-term. Last year, refiners delayed projects due to high 3:2:1 crack spreads; now, they’re making up for it with more maintenance than usual. Refinery utilization is hovering around 86% as a result of planned downtime, a bit lower than average for this time of year.

Meanwhile, despite sanctions, Russian supply still seems to be sneaking through to the market. European fuel markets are healthy thanks to stockpiling, and so far, there have not been significant concerns of fuel shortages. With the market adequately supplied, current refinery outages should not cause such significant price swings as those seen last year. Even more positively, many refinery outages affecting the market, such as in Colorado and Ohio, are expected to return to normal operations in April and May.

Between now and the end of the year, 430kbpd of new refining capacity is expected to be added to the market. In a market that’s been chronically short on refined fuels, that should help inventories improve. Speaking of inventory, US crude inventory levels are roughly 7% above the five-year average for this time of year at 478.5 million barrels. Total motor gasoline and distillate fuel inventories fell by 1.1 million barrels and 0.1 million barrels from last week’s levels, respectively. The tightness of the refined products combined with an ample supply of crude is handing the refiners healthy crack spreads. Although spreads are not as high as they were last year, they remain notably higher than average.

Prices in Review

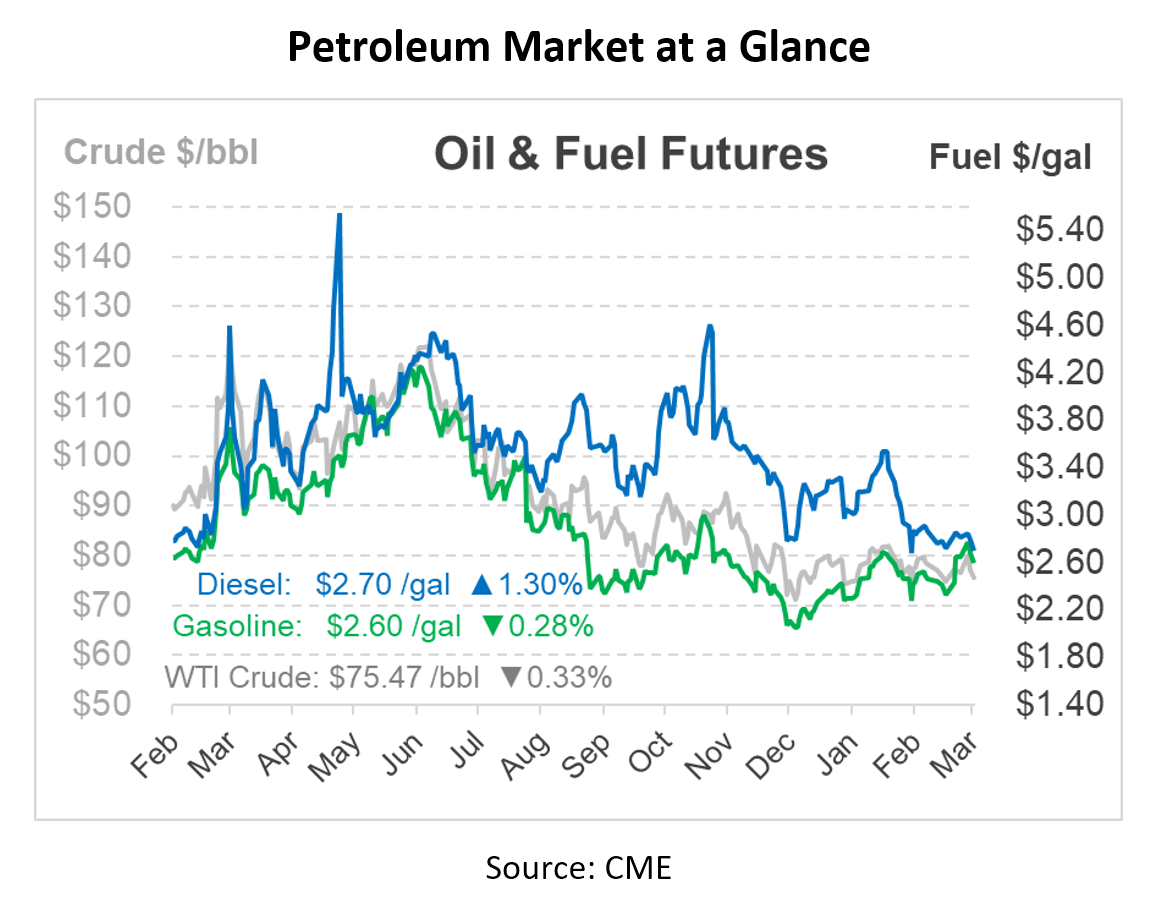

After the sell-off on Thursday, oil and refined product futures are trading lower this morning and may be headed for substantial weekly declines. Although roughly $5 lower than they were a week ago, oil futures are still trading in the $75-$80 range that’s been typical for the past few months. With West Texas Intermediate futures regaining the $80/bbl level and gasoline futures landing at a 2023 high, there appeared to be a growth spurt early in the week, but the momentum faded later.

Crude prices are near their weakest point for the week and since the end of February. Crude opened the week at $79.92 and peaked Tuesday at a high of $80.50 before trending downward for the rest of the week. This morning crude began trading at $75.65, a decline of $4.27 (-5.34%).

The April NYMEX ULSD contract has lost 24.5cts in value over the past four days. Diesel opened the week at its weekly high of $2.9099 and quickly began its descent. Today, diesel opened at $2.6664, a drop of 24 cents (-8.37%).

For three consecutive days, gasoline futures have taken a hit, shedding around 20 cents. Gasoline held steady with diesel and crude for weekly declines opening the week at $2.7550 and topping out at $2.7962 on Tuesday. This morning, gasoline opened at $2.6011, down 15 cents (-5.59%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.