Week in Review – June 19, 2020

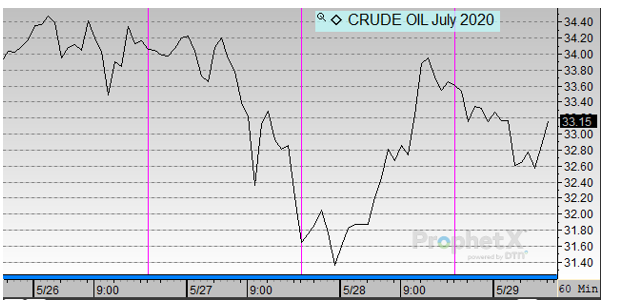

WTI Crude finished the week strongly and is sharply rising in early trading this morning. Positive macroeconomic support earlier in the week from the White House and the Fed is being weighed against fears of a second wave of COVID-19.

Fuel markets received support mid-week from the EIA’s inventory report, which included the first diesel inventory draw in several weeks. As demand rises, markets are gaining confidence that a return to normal will continue uninhibited by rising COVID-19 cases.

In renewables news, RIN prices rose earlier this week on the news that the EPA would propose a 250 million gallon increase in the upcoming 2021 Renewable Volume Obligation (RVO) and another 250 million gallons added to the 2022 RVO. Renewable identification numbers (RINs) are credits used for compliance and are the “currency” of the Renewable Fuel Standard (RFS) program. As the week progressed, sellers entered the market and erased early gains as uncertainty about renewable fuel policy made markets skittish.

On June 12, 2020, Flint Hills Resources announced that it would permanently close its ethanol plant in Camilla, GA, due to a lack of demand for products caused by the coronavirus pandemic. The only ethanol production facility in Georgia has been idled since May. It has an annual production capacity of 120 million gallons per year. Ethanol production is down 24% as measured this week versus the same week last year.

Prices in Review

WTI Crude opened the week at $36.03. It followed an upward track throughout the week, stalling on Wednesday before resuming its climb. Crude opened Friday at $38.85, a gain of $2.82 (7.8%).

Diesel opened the week at $1.1053, and generally followed crude trends throughout the week. Diesel opened Friday at $1.2010, a gain of 9.6 cents (8.7%).

Gasoline opened the week at $1.1208. Like the rest of the petroleum market, gasoline prices felt the positive support of economic reopening. Gasoline opened Friday at $1.2654, posting the largest percentage gains of the three products with a gain of 14.5 cents (12.9%).

This article is part of Daily Market News & Insights

Tagged: gasoline demand, Iraq, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.