Week In Review – July 9, 2021

After a long string of oil price gains, oil prices fell this week as the OPEC meeting last week crumbled. Although the group was voting on increasing production – and thus no vote means less production, which should cause higher prices – the market reaction has been bearish. Traders fear that the UAE and other producers may buck the agreement completely and boost output, causing a repeat of 2020’s oil glut.

Over the past week, the UAE has balked at extending cuts through the end of 2022, eight months longer than the original agreement required. Insisting on a higher base of production, the UAE held talks hostage last week in an effort to secure an extra 700 kbpd of output. The country is investing billions to grow its output from 3.8 MMbpd to 5 MMbpd by the end of the decade; current OPEC cuts assume they can only produce 3.2 MMbpd. The country also wants to establish its own futures market for its local Murban crude blend – a first for an OPEC country. By holding the line and demanding recognition for its oil production capacity growth, the UAE is setting the foundation for its future investment in oil demand.

Over the weekend, Hurricane Elsa strengthened, then weakened as it cruised towards Florida. The storm made impact as a tropical storm, temporarily disrupting local fuel deliveries.

This Week in Energy Prices

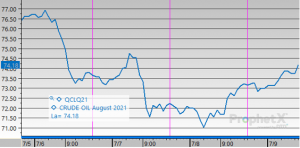

Today crude opened at a price of $73.26, a change of $2.09 from Tuesday’s opening price of $75.35. Crude changed throughout the week, hovering around the $73 mark. Extremely volatile prices were the result of ongoing OPEC+ talks regarding production output.

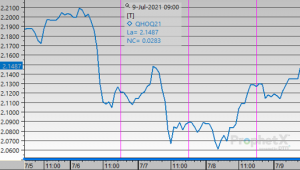

Today diesel opened at $2.1281, a change of $0.0509 from Tuesday’s opening price of $2.1790. Tuesday’s opening price of $2.1790 represented the highest opening of the week, and prices showed many changes throughout the week, with the biggest drop off happening between Tuesday and Wednesday.

Today gasoline opened at a price of $2.2625, a change of $0.0415 from Tuesday’s opening price of $2.3040. Prices shifted throughout the week in correlation with the ongoing volatility shown in crude and diesel. This week for gasoline showed the highest opening price occurring Monday, but then dropping off Tuesday.

This article is part of Daily Market News & Insights

Tagged: energy prices, opec, UAE

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.