Week in Review – July 8, 2022

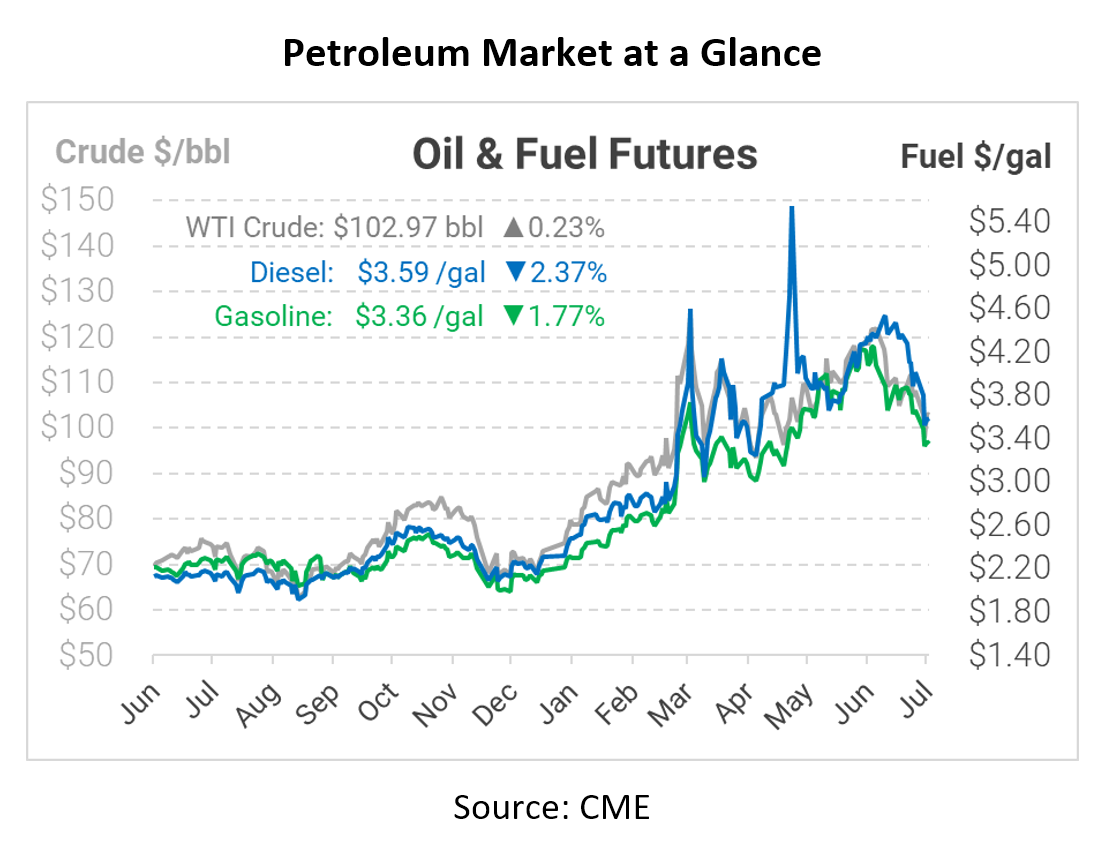

This week saw a steep selloff in oil markets, bringing crude prices below $100/bbl for the first time since May. At the same time, fuel prices slid 15-20 cents per gallon from last week’s levels. The topic on everyone’s mind is the economy – rising interest rates threaten to tighten spending and slow accelerating growth. With trading volumes light due to the holiday week, the market moved faster than it normally might have, sending prices spiraling. A survey last month revealed that 70% of academic economists expect a recession over the coming year. Recessions bring lower demand, causing prices to fall.

Along with economic woes, the market digested the EIA’s delayed market report yesterday. The data shows that crude inventories rose 8 million barrels last week, an increase double typical weekly swings. On the flip side, diesel and gasoline stocks fell by 1.3 million barrels and 2.5 million barrels, respectively. Refiners are working near their maximums to supply fuel markets, utilizing 94.5% of available capacity (down from 95.0% last week). Many refiners have delayed maintenance to satisfy fuel markets, which could bring challenges as hurricane season strengthens.

The data also showed a strong up-tick in fuel demand. Across all products, demand last week was over 20 million barrels per day, the highest weekly demand stat since March. Gasoline demand rose by nearly 500 thousand barrels per day (+5.5%) from the prior week, and diesel demand rose by 800 kbpd (+23%). Those numbers are pre-holiday numbers, so expect another strong report next week. Even with rising demand and falling inventories, markets are seeing fuel prices decline this morning on continued economic fears – perhaps fears that are detached from reality, as we noted in yesterday’s article.

Prices in Review

Crude oil prices collapsed early in the week, with Tuesday seeing crude oil fall from above $110 to just $98 per barrel. Prices traded sideways in the middle of the week before popping higher on Thursday, as markets corrected from their Tuesday selloff. On Friday, crude oil opened at $102.22, down $6.58 (-6.4%) from Tuesday’s opening price.

Diesel prices also experienced a huge drop this week, opening the week at $3.95 but fell 35 cents lower on Tuesday. Prices continued falling on Wednesday, hitting a low near $3.35 before rebounding. After a long week of volatility and (thankfully) lower prices, diesel opened Friday at $3.67 – a loss of 28 cents (-7.1%).

Gasoline was not immune from volatility this week, seeing its own dramatic swings. Opening at $3.65 on Monday, prices fell to a low of $3.20 – 45 cents lower – before springing higher. On Friday prices opened at $3.41, a loss of 24 cent s(-6.7%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.