Week in Review – January 7, 2022

Starting off the week we saw headlines that warned of colder weather making its way across much of the southeast. Today alone over 60 million people are under winter alerts, with schools and government entities to be closed down. With this cold front, new storms have emerged across much of the south, causing more trouble for airline companies as they try to continue navigating through Omicron scares and employee shortages.

Colder weather is also bringing higher demand for heating oil. Yesterday, powerful storms swept across the southern United States, knocking out power and taking down trees in their paths. This lost power can mean more generators needing diesel in areas plagued by the storm paths. Many areas of Alabama had such severe weather that roads were temporarily closed to prevent people from driving over downed power lines. With these road closures throughout the south, fuel deliveries could be expected to be delayed. These storms were connected to the same system that saw severe flooding and tornadoes in Kentucky.

Also making weekly headlines was more on the DEF shortage, that continues to challenge the supply chain. Required since 2010, DEF is a must-have for any fuel program, so any disruption to the supply chain could have impactful consequences if it is not addressed. Major DEF manufacturers are struggling to maintain supplies. Most of the major manufacturers have changed annual contracts to monthly spot-priced allocations. Many are reducing their DEF output to increase fertilizer production. In addition to rising DEF prices, logistics challenges have become commonplace. Because the DEF industry is far newer than the fuel industry, there is not as much redundancy among freight capacity. While there are thousands of fuel distributors across the US and Canada, only a handful distribute DEF. A few sick drivers, delayed truck maintenance, a supply point outage – any number of factors can severely hamper supply in a region.

Lastly, later in the week we saw prices hit a fresh 2-month high. On Wednesday diesel prices were above $2.40 at a wholesale level. OPEC+ this week agreed to increase their output by 400 kbpd once again, continuing the steady approach implemented last August. Seven months later, those individual increases amount to 2.8 million barrels per day, though countries have struggled to keep pace with those increases given logistics constraints. Despite requests from oil-consuming nations to speed up production, OPEC+ has been taking a slower, politically easier route.

Prices in Review

WTI Crude opened the week at $75.69. Prices increased steadily throughout the week, hitting a high on Friday. Crude opened Friday at $79.62, an increase of $3.93 from Monday.

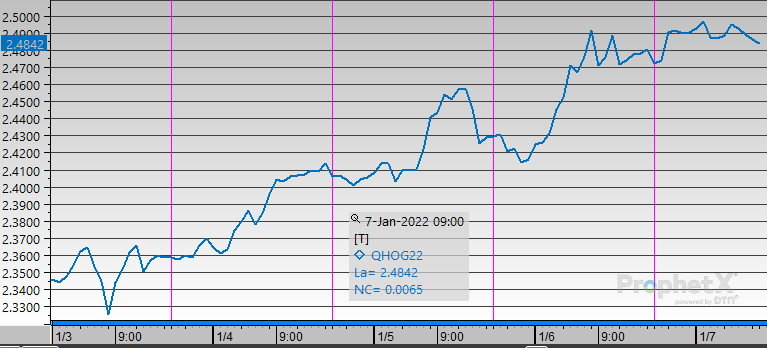

Diesel opened the week at $2.3283. Diesel also rose steadily this week, similar to crude. It opened Friday at $2.4790, an increase of $0.1507 from Monday.

Gasoline opened the week at $2.2206. Prices were volatile throughout the week with many changes. Today prices are up with gasoline opening at $2.3075, up $0.0869 from Monday’s opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.