Week in Review – January 29, 2021

This week was full of price swings, but none of those swings resulted in a meaningful trend for the week. The oil market seemed to be taking in new political news carefully, tucking it away rather than acting on it. This week certainly wasn’t short on political news – from stimulus deal fighting to Biden unilaterally pausing new leases of federal land, plenty happened this week that could have driven markets.

The week opened with markets focused on Middle Eastern news. Iraq announced they would be cutting their supply to make up for over-production in 2020, though given similar promises, markets took the announcement with a heavy dose of skepticism. At the same time, instability in Libya threatened eastern fuel facilities, hinting that their production might once again be shut off for a period. Neither news event caused any immediate change in supply, so markets shook them off quickly.

Midweek, the EIA revealed that crude inventories fell by over 9 million barrels, the largest stock draw since July. Even that sizable movement did not materially drive prices; WTI crude rose by a dollar, but quickly shed its gains that day. The report also showed that refiners continue to maintain roughly 80% utilization – higher than during the worst parts of the 2020 pandemic, but still far below normal levels.

Later in the week, focus shifted back to politics and vaccines. Throughout the week, pundits weighed in on Biden’s pause for leases of federal land. Opponents argued the move would cost jobs and increase America’s reliance on foreign oil. Proponents of the pause responded that the order is temporary, and that oil companies already have enough leases to last years without impacting output.

Prices in Review

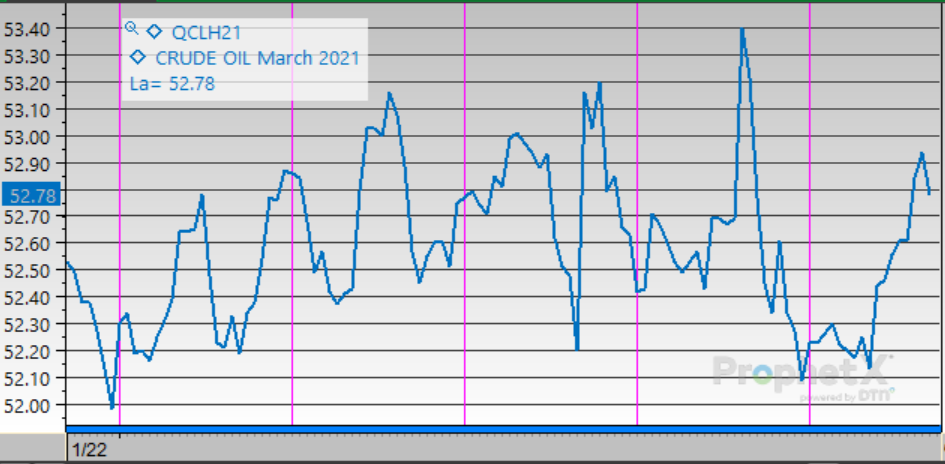

Oil remained in a very narrow trading band this week, never straying from its $1.50/bbl range. But within that band, prices gyrated wildly, showing a fight between bulls and bears each day. There wasn’t much of a pattern in prices. Prices opened on Monday at $52.17, and this morning prices opened a whopping two cents lower.

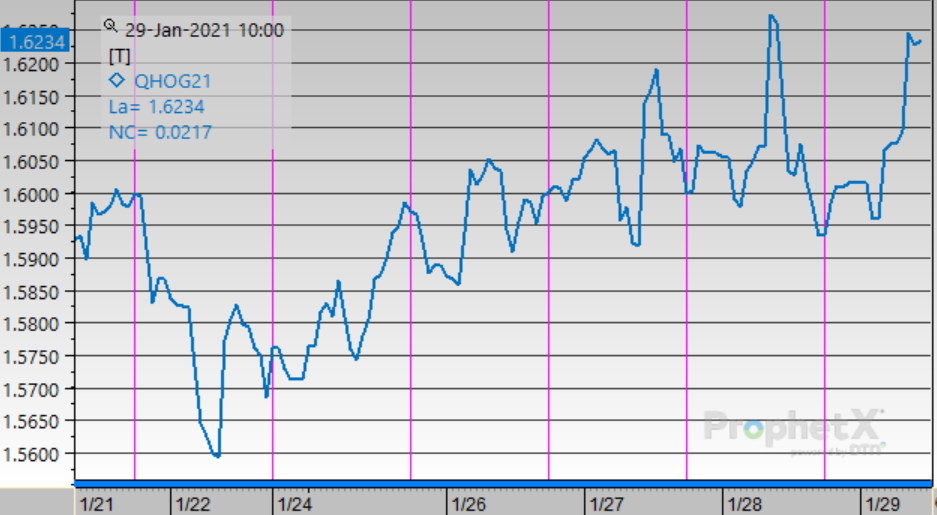

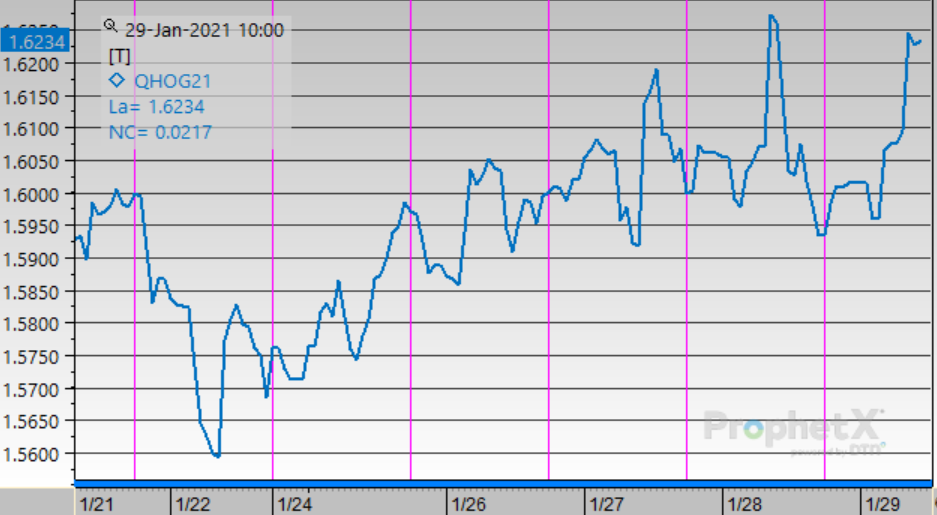

Fuel prices were more dynamic than crude this week, showing an overall trend higher through the week. Rising diesel and gasoline prices helped push 3:2:1 crack spreads higher, which could support refiner utilization in the coming weeks. Diesel began the week at $1.5736, climbing throughout the week. Thursday saw prices peak above $1.60 before settling lower. On Friday, the market opened at $1.5983, a gain of 2.5 cents.

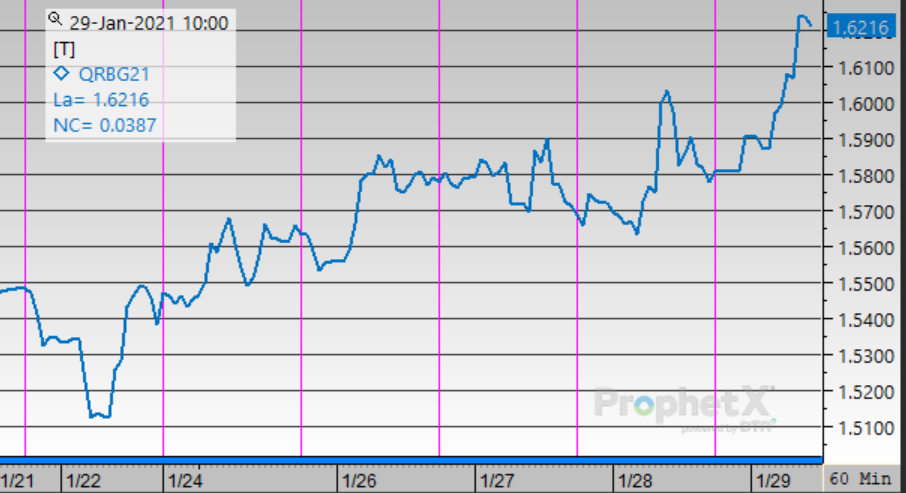

Gasoline was the biggest winner this week, seeing huge rallies as vaccines continue enticing consumers to leave their house and resume normal life. Beginning the week at $1.5419, gasoline prices climbed steadily throughout the week, opening on Friday at $1.5806 – a 3.9 cent gain.

This article is part of Daily Market News & Insights

Tagged: COVID-19, Oil Majors, vaccines

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.