Week in Review – February 28, 2020

The crude market was down for the week and continues its downward trend in early trading this morning. The major news moving markets this week was all about the coronavirus and its rapid spread outside of China. South Korea, Iran, Italy and Japan among others, are all taking major steps to slow the spread of the virus within their borders. The Centers for Disease Control in the US have stated that it is not a matter of “if” the coronavirus will come to the US, but “when.”

The White House has asked for $1.25 billion in funding from Congress and the authority to direct an additional $1.25 billion from other programs to fight the coronavirus in the US. Some members of Congress have complained that these figures are too low to effectively combat the virus.

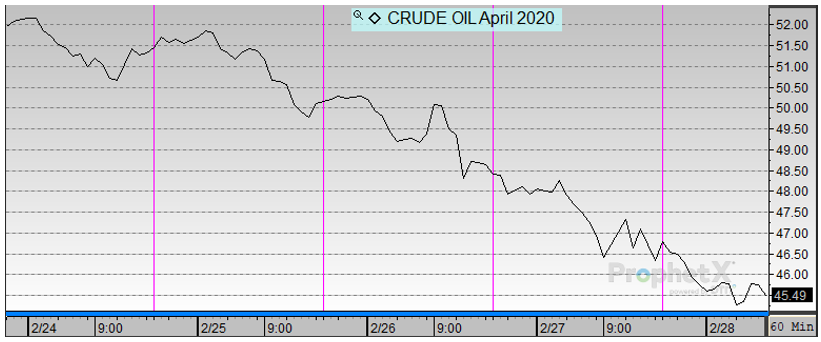

The markets continue to digest the dire news and the news is exerting downward pressure on prices. WTI Crude is trading at the lowest levels since January 2019.

Prices in Review

WTI Crude opened the week at $52.60. It followed a downward trend all week as additional news of the spread of the coronavirus came in. Crude opened Friday at $46.49, a loss of $6.11 (-11.6%).

Diesel opened the week at $1.6726. It followed crude on its downward trend through the week. Diesel opened Friday at $1.4808, a loss of 19.2 cents (-11.5%).

Gasoline opened the week at $1.6331. It generally followed crude throughout the week. Gasoline opened Friday at $1.3954, a loss of 23.8 cents (-14.6%).

This article is part of Crude

Tagged: Centers for Disease Control, coronavirus, crude, diesel, gasoline, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.