Week in Review – February 11, 2022

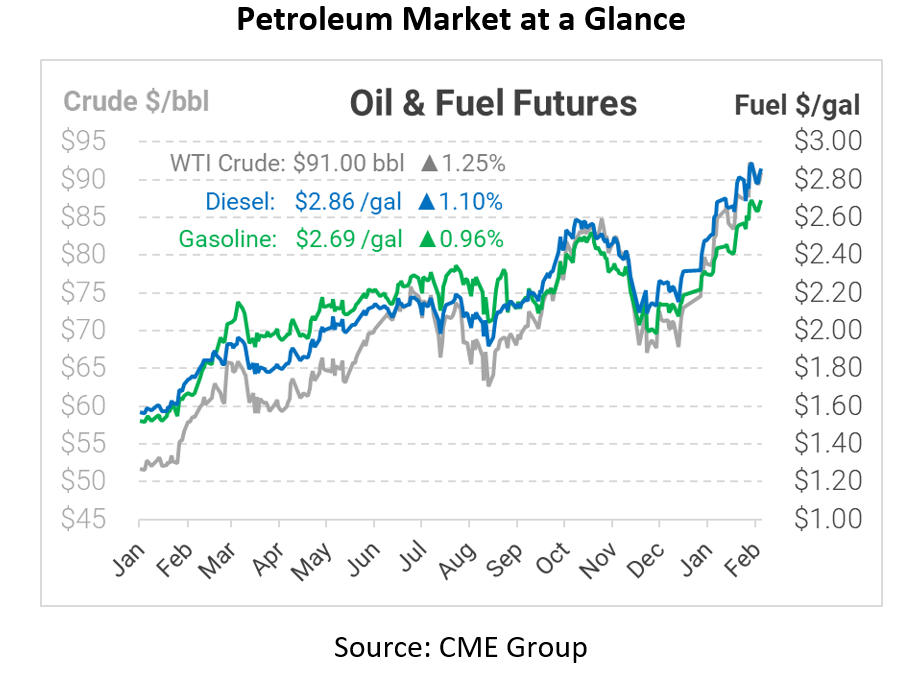

This week major headlines included Biden oil policies not going in his favor anymore, news on U.S.-Iranian talks about a resumption of a nuclear deal, and inventory levels being the lowest since 2018. While seems thing to be continuously going wrong for oil prices, there are some events that could help lift the pressure off rising oil prices.

New realities about the price of oil are landing hard in Washington, D.C., where anti-energy policies are starting to look more and more ineffective. Disruptions of the supply chain are ongoing, and gas prices at retail stations are averaging more than $3.41 per gallon. With prices for gasoline climbing upwards of 58%, the question about what relief – if any – the market will provide is becoming more and more pronounced. To make matters worse for the Biden administration, they have begun to backtrack on old policies and have asked shale companies to add more rigs and drills to their leases in a desperate attempt to correct the market. Biden’s approval rating has reaching an all-time low of 41%, something he may want to attempt to correct soon.

Also, this week the world eagerly awaits the possibility of a nuclear deal being reached between the Iranian government and the United States. Such a deal could potentially lift much needed pressure off the price of oil. This international nuclear agreement discussed before would allow more than 1 million barrels per day (bpd) of Iranian oil to be added back to the market. This would equate to around 1% of global supply being added back, certainly helping prices if it were to happen. For Iran, their demands seem to be cemented in the idea that they want all Trump-era sanctions lifted, but it is unclear whether the United States would act upon that demand.

Lastly, during the week readers learned of inventory levels hitting lows not seen since 2018. U.S. Energy Information Agency (EIA) reports this week shined a light on current inventory levels that have not been this low since 2018. Crude oil inventories dropped by 4.8 million barrels to 410.4 million barrels. This inventory fall combined with the past four weeks of product supplied being 21.9 barrels per day has now let demand hit an all-time high. Recently refiners have been ramping up activity due to a need to keep up with growing demand, so until this balances out, markets will be expected to remain tight.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.