Week in Review – August 7, 2020

WTI Crude finished the week higher amid a large crude draw mid-week and falling rig counts. Higher refinery utilization helped WTI crude stocks fall this week, but demand for products could not soak up all the excess production as distillates and gasoline inventories increased.

Rig counts have fallen 67% from March highs to 263 active rigs. Rig counts are expected to remain near these lows for the remainder of the year. The total number of active rigs is a good indicator of future production potential with fewer rigs indicating lower future production.

In weather news, Tropical Storm Isaias pounded the east coast from the Carolinas to New Jersey with rains, winds, storm surge, and flooding. The storm caused power outages up and down the coast; however, the storm had minimal impacts on energy infrastructure in the affected regions.

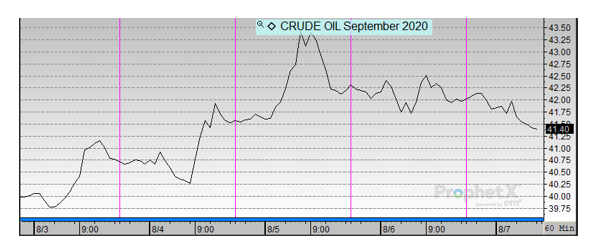

Prices in Review

WTI Crude opened the week at $40.39. It peaked mid-week on inventory news but gave back some gains to close the week. Crude opened Friday at $41.97, an increase of $1.58 (3.9%).

Diesel opened the week at $1.2283. It generally followed crude throughout the week. Diesel opened Friday at $1.2516, a gain of 2.3 cents (1.9%).

Gasoline opened the week at $1.1740. It peaked mid-week but gave back less of its gains to close the week. Gasoline opened Friday at $1.2315, a gain of 5.8 cents (4.9%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.