Week in Review

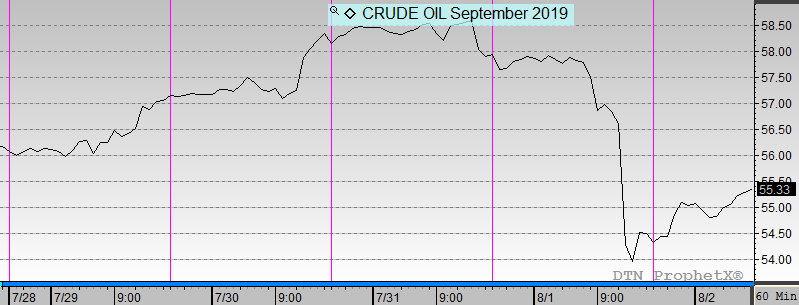

For the week, the crude market was down. On Monday the market opened up on the heels of renewed U.S.-China trade talks. Tuesday saw gains based on API data showing a large draw. Wednesday saw conflicting factors pulling the market in both directions. Wednesday’s EIA data confirmed an even larger than anticipated draw on crude stocks, but gains were tempered by the Fed’s position that although they cut 25 basis points on Wednesday, future cuts were not assured. Equities dipped sharply and pulled crude down.

The big news of the week, however, came on Thursday when President Trump tweeted that 10% tariffs would be imposed on the remaining $300 billion of Chinese goods starting in September, triggering renewed fears of a global economic slowdown and decreased oil demand. Equities reversed course from big gains to big losses. The announcement also caused oil to drop more than 8%, the largest one day drop in almost 5 years. The crude market seems to be recovering somewhat in early trading on Friday morning.

Prices in Review

WTI Crude opened the week at $56.20. After news of new Chinese tariffs and fear of slowing oil demand, markets headed lower. Crude opened Friday at $54.54, a loss of $1.66 (-3.0%). It’s worth noting that despite one of the largest down-days in years, steady gains early in the week offset much of the downward price move.

Diesel opened the week at $1.9042. It followed crude down this week. Diesel opened Friday at $1.8709, a loss of 3.3 cents (-1.7%).

Gasoline opened the week at $1.8769. It also followed crude lower after talk of new tariffs. Gasoline opened Friday at $1.7550, a loss of 12.2 cents (-6.5%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.