Week in Review

As of Friday’s open, the crude market is down for the week. The week started out inching higher on the heels of the previous week’s losses. Mid-week, China escalated trade tensions with talk of cutting rare earth exports to the U.S. This, along with smaller than expected crude draw, sparked a down turn in the market early on Wednesday. However, a rally in afternoon trading on Wednesday helped to wipe away most of those losses. The market took a nose dive on Thursday based on fears of a global economic slowdown and slowing oil demand and the losses continue in early trading on Friday morning.

Saudi Arabia called several emergency summits of different organizations to which they belong. These summits are to discuss a response to attacks on Saudi oil stations which have been attributed to Iranian-backed forces. Iran has denied involvement, but U.S. National Security Advisor John Bolton has indicated American beliefs to the contrary.

Prices in Review

WTI Crude opened the week on Tuesday at $58.94. Fears of global economic slowdown after China’s trade war escalation mid-week helped to drive prices lower as the week closes. It opened Friday at $56.46, a loss of $2.48 (-4.2%).

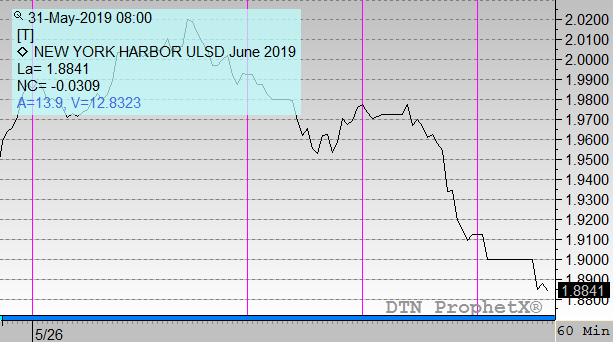

Diesel opened the week at $1.9794. It generally followed crude lower this week. It opened Friday at $1.900, a loss of 7.9 cents (-4.0%).

Gasoline opened the week at $1.9430. It followed crude lower through the week. The reported mid-week surprise build also drove prices lower. It opened Friday at $1.8786, a loss of 6.4 cents (3.3%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.