Week in Review

As of Friday’s open, the crude market is down for the week. The week started out relatively flat as markets could not decide which way to go. Deteriorating U.S.-China trade negotiations and a strong dollar moved oil prices lower in the beginning of the week. Tensions with Iran and geopolitical instability pushed oil prices in the other direction. The tug of war got an unexpected pull mid-week.

The turning point in the week came on the heels of EIA inventory data reported Wednesday. The EIA reported a sizable build in crude and the market responded by tanking on Wednesday and Thursday. In the face of sanctions, OPEC+ supply restrictions, and geopolitical instability of the past few weeks, the crude build was a surprise and the market responded aggressively.

Prices in Review

WTI Crude opened the week at $62.93. The reported crude build mid-week drove prices lower, but the bulls seem to be making headway in early trading this morning. It opened Friday at $58.21, a loss of $4.72 (-7.5%).

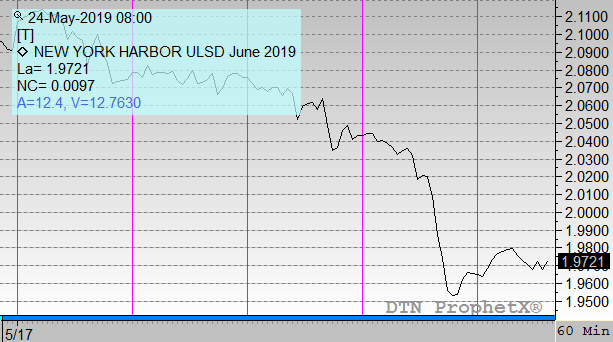

Diesel opened the week at $2.0955. It followed crude lower this week. It opened Friday at $1.9660, a loss of nearly 13 cents, (-6.2%).

Gasoline opened the week at $2.0468. The EIA reported a surprise build in Gasoline mid-week and it followed crude lower to close out the week. It opened Friday at $1.9195 a loss of 12.7 cents (-6.2%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.