Week in Review

This week has been a roller coaster ride for oil prices, with huge losses on Monday falling away to yield crude oil’s second highest closing price of the year on Thursday. $2/bbl swing on Monday was driven by Donald Trump’s tweet that oil prices were too high and OPEC should “relax” their production cuts. The fact that his tweet, with no real action behind it, could so significantly later the oil arena demonstrates how uncertain oil markets are. They’re ready to move 5% higher or lower with just a tweet to drive them!

This week’s EIA report brought the second major price action of the week, a quick and decisive return to higher levels. Imports fell to a 13-year low thanks to flagging output from Canada and Venezuela and intentional cuts from Saudi Arabia. In fact, the US was a net oil exporter for the week, a status the EIA expects to become more frequent over the coming year. Crude oil saw very sharp draws for the week as a result of lower imports, contributing to the higher price activity.

Prices in Review

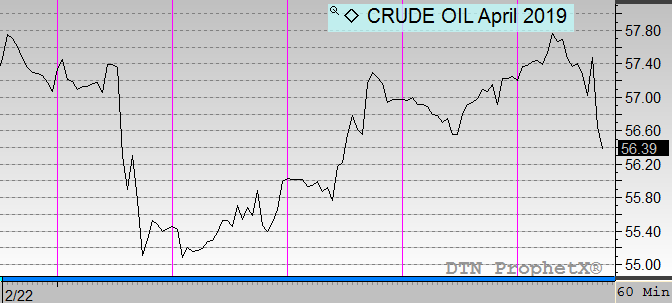

Crude oil prices look like a roller coaster, spiraling downwards before a bumpy climb higher, with another big plunge at the end. Crude opened the week at $57.17, building on the prior week’s gains. But by the end of that trading session, oil was trading almost two dollars lower. The market seemed to recover as the week continued, with a bullish EIA report spurring a large rally on Wednesday. This morning oil opened at $57.22, a tiny gain that has already been eroded in morning trading.

Diesel prices saw a similar down-up-down pattern for the week, though with stronger gains on Tuesday and muted activity Thursday. Diesel opened this week at $2.1282, plummeted to $1.9746, then began climbing higher for the week. This morning prices opened at $2.0293, just barely above the starting point for the week.

Gasoline’s chart is influenced by the expiration of March contracts and the roll to April contracts, when refiners must produce more expensive summer gasoline rates. Opening the week at $1.5971, gasoline this morning opened at $1.7521 – suggesting a massive gain. But comparing apples to apples, the April futures contract opened Monday at $1.7502, so today’s opening price was actually only a meager gain.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.