Week in Review

As the week comes to a close, oil prices are quickly rising towards the upper end of the $53-$55/bbl range in which WTI crude has been bound for the last few weeks. Whether or not this will be the market’s opportunity to break from this range is yet to be seen. Recent economic data, including US retail sales and Chinese GDP and manufacturing data, have all pointed to slowing growth for the global economy. Yet supplies are also being diminished thanks to the OPEC agreement and Venezuela sanctions, not to mention Canada’s decision to limit output in Alberta. Still, there are concerns – Russia’s head of Rosneft this week noted that the OPEC+ deal is not in Russia’s best interest, leading some to wonder whether the deal will hold. Lower demand and lower supply are competing to influence oil prices, and so far neither has come out the winner.

The risk factors in the market, ranging from Libya to Nigeria to Venezuela, seem to suggest that caution is warranted. There are a number of risks to oil output, which could send supplies falling even faster than demand. On the economic side, a resolution to the US-China trade war could send demand prospects (and oil prices) soaring higher, while Hard Brexit and economic malaise looms as a possibility if no deal is reached between Britain and the EU before March 29.

Prices in Review

Crude oil prices saw steady gains throughout the week, reaching higher levels each day. The WTI contract opened the month at $52.66, and prices eked out meager gains each day thereafter. Tuesday saw prices swell briefly before falling back a bit, and Thursday saw a brief dip before rallying to end the day. This morning crude oil opened at $54.48, a gain of $1.82 (3.5%) for the week.

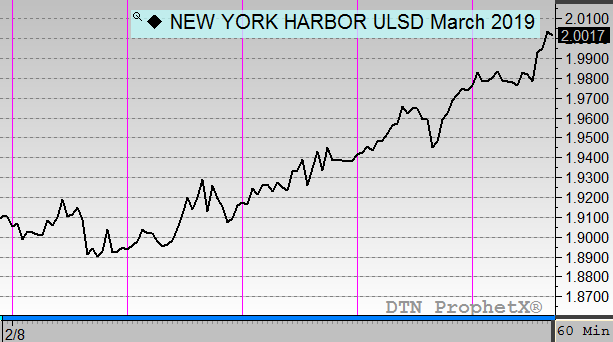

Fuel prices enjoyed similar growth this week, with the bulk of the gains coming on Wednesday and Thursday as data showed refinery utilization rates plunging this week. Diesel prices opened the week at $1.91, and climbed throughout the week to open this morning at $1.9748 – a gain of 6.5 cents (3.4%). This morning, prices have even exceed $2/gal for the first time in months.

Gasoline managed to mount a rally that sent prices climbing above $1.50 for the week, a strong performance after languishing for months. Gasoline opened on Monday at $1.44, and climbed to open at $1.51 this morning – a gain of almost 7 cents, representing a whopping 4.8% increase for the week. Further gains this morning are helping to make this week one of the most significant gasoline rallies in months.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.